Cfa trading strategies

The Chartered Financial Analyst is one of the most sought after and well-recognized credentials in the financial community. The program is notorious for its high attrition rates, level of difficulty, and time commitment necessary to successfully pass and earn the coveted designation of CFA.

However, for anyone looking to begin a career day trading, the CFA program's scientific approach to investment analysis may seem largely at odds with the fast-paced world of speculation. While the CFA is by no means necessary for a career in day trading, the wealth of information learned through the CFA program will not hinder a potential day trader, and it can serve as an additional tool in their arsenal to tackle the challenges of navigating markets.

The CFA program is known for its academic rigor and thorough presentation of the tools and techniques necessary to become a financial analyst. There are three levels of the CFA exam that must be completed, along with four years of applicable work experience in order to earn the designation of Chartered Financial Analyst. The breakdown of the three CFA exam levels are as follows:. As you can see, the Level I curriculum covers a fairly equal weight of topics with an emphasis on ethics which is throughout all three levels and financial reporting and analysis FRA.

FRA in Level I is focused on learning the terms, techniques, and analysis of financial statements as reported by a company. It lays the groundwork for equity analysis, forecasts, and portfolio management in the following levels.

While Level I covers abroad array of financial topics, Level II expands upon the major topics of Level I with an emphasis on the valuation of assets. Finally, Level III consists of applying all that was covered in the last two levels to successfully manage a portfolio consisting of multiple asset classes. Below is a table from the CFA Institute that highlights the broad career paths of its member charterholders as of Day trading is speculative in nature, and occupies the shortest time frame when compared to swing traders and investors.

Since day traders rarely if ever hold their positions overnight, they must have a thorough understanding of price and volume data and technical analysis.

Thus, day traders can feel pretty comfortable trading equities, derivatives, and forex. Some common strategies employed by day traders are:. The CFA curriculum follows a contrasting philosophy, with a heavy emphasis on diligent fundamental research geared towards portfolio management—a world in which trading such short time spans is neither encouraged nor generally accepted.

Moreover, all the information presented in the CFAI materials has been thoroughly researched or validated and developed through empirical means. The CFA curriculum consists of hard science and calculations that focus on objective data. Technical analysis is subjective in nature and controversial in its validity. Although this is not to say that it is ineffective. Therefore, the day trader would be better served learning the nuances of technical analysis straight from specialized sources that deal in the matter and actually day trading or sim trading , as opposed to trying to hone their craft through the CFAI materials.

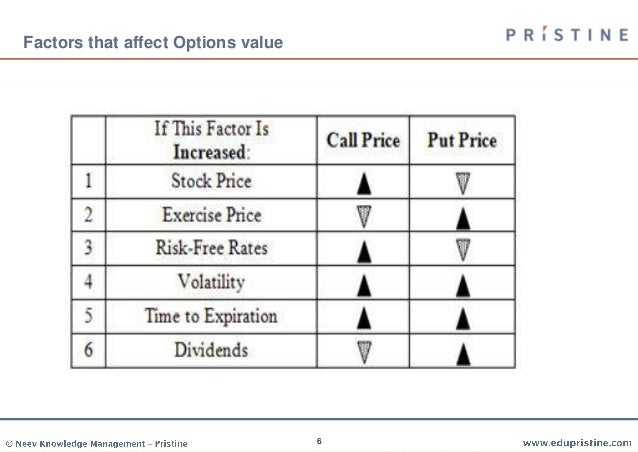

In fact, the CFAI devotes a very small and basic section to technical analysis in Level I only. Furthermore, there are certain crucial concepts that a day trader must understand that can only be learned through actual day trades, or through resources dedicated to these concepts. The CFAI curriculum, while incredibly thorough in its material, simply does not have time to include all the common concepts that day traders may encounter on a daily basis, such as stock scalping , short squeezes , high-frequency finance and the properties of trading algorithms , option pin risks and volatility around option expiration dates , level II analysis , and general order placements.

Most importantly, the CFA requires a recommended commitment of hours of studying per level to pass each exam, as well as four years of applicable work experience.

SpeedTrader - Low Cost Stocks & Options Broker

Although day traders may very well be on the opposite end of the finance spectrum from portfolio managers and analysts, the CFA does contain a wealth of information about the financial topics, and this extra information can never be a hindrance. Any trader that wishes to be a student of the markets can find incredible value in the CFAI materials that can be immediately added to their trading repertoire or as a reference point to guide their decision making.

Madison County Courier

For instance, if an earnings report was released in the pre-market, the day trader can use any of the FRA techniques from the CFA to make sense of how this will play out for the stock during the day. Traders employed in professional firms, may also have to use economic, equity valuation, and fixed income concepts to make sense of the orders they receive from the portfolio management teams.

The CFA program is focused on conducting diligent research on a variety of asset classes, which is reflected by the majority of charterholders pursuing careers in portfolio management or research positions.

Therefore, the CFA program may seem slow and rigid compared to the fast-paced world of charts and chaos that the day trader thrives in.

Dictionary Term Of The Day. A hybrid of debt and equity financing that is typically used to finance the expansion Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How Useful Is the CFA For A Day Trading Career?

By Zaw Thiha Tun April 14, — The CFA Curriculum and Careers The CFA program is known for its academic rigor and thorough presentation of the tools and techniques necessary to become a financial analyst. The breakdown of the three CFA exam levels are as follows: CFA Institute As you can see, the Level I curriculum covers a fairly equal weight of topics with an emphasis on ethics which is throughout all three levels and financial reporting and analysis FRA.

Day Trading Principles and Techniques Day trading is speculative in nature, and occupies the shortest time frame when compared to swing traders and investors. Some common strategies employed by day traders are: Day traders usually employ candlestick charting techniques in their analysis within ranges between 30 seconds to five minutes. A common usage of both simple and exponential moving averages are their crossovers , for both buy and sell signals, and using the moving averages as support and resistance guidelines.

The moving average convergence divergence MACD , Bollinger Bands and the Relative Strength Index RSI are common indicators that can lead to buy and sell signals. Patterns and Support and Resistance: Day traders may employ any of the various types of patterns common in technical analysis.

Support and resistance can be calculated in a number of ways, but the most commonly used methods are Fibonacci retracements and pivot points. The Benefit of a CFA for Day Traders Although day traders may very well be on the opposite end of the finance spectrum from portfolio managers and analysts, the CFA does contain a wealth of information about the financial topics, and this extra information can never be a hindrance.

The Bottom Line The CFA program is focused on conducting diligent research on a variety of asset classes, which is reflected by the majority of charterholders pursuing careers in portfolio management or research positions. Find out how to get yourself ready for these lengthy and often daunting exams.

The Level III exam is one of the tougher exams for the CFA. Read this to give yourself a little insight. Learn about the different traders and explore in detail the broader approach that looks to the past to predict the future. Options are often the bread and butter of day traders. Here are some of the more common types of options. We look at some popular undergrad majors for those wanting to begin a career in the exciting world of fast-paced trading. This article will take an objective look at day trading, who does it and how it is done.

Learn the most common technical indicators that forex traders and currency market analysts utilize to predict likely market Types Of Analysis Used In ForexForex analysis is used by the retail forex day trader to determine whether to buy or sell Understand what technical analysis is, the basic theory behind employing it and what data inputs are needed to conduct it.

A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Net Margin is the ratio of net profits to revenues for a company or business segment - typically expressed as a percentage No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Book Review: Efficiently Inefficient | CFA Institute Enterprising Investor

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy. Portfolio Management and Wealth Planning.