Disadvantages of employee stock options

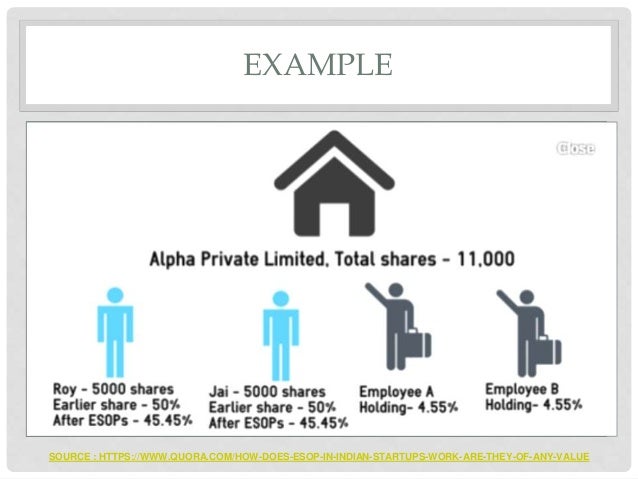

December 5, at 6: The company issues a certain number of shares for the employees at a fixed price for a given period with an option granted for them to purchase.

This type of option is known as Stock Option.

The purchase price is otherwise known as strike price which is an actual representation of stock value in the market at the time of purchasing.

The employees before exercising their rights to purchase share at the strike price must wait until the option are vested which usually last for four years.

During the period of vest, the market value of the stock may be increased which pay an easy way for the employees to buy shares at discount. The employee gain can be determined by the difference between the strike price and the market price on the day the option are exercised. When the employees become the owner of the stock he can possess it or can sell the shares depending on the market status.

In the past Stock Option are granted in form of compensation were top executives and outside directors alone got the chance. From 's onwards option was given to all employees.

Employees become the owner of the disadvantages of employee stock options, so there is a good chance for the employee to take more responsibility and regarding performance they put up more effort to get the libri per studiare forex hand.

In order to reap the future reward, the company attracts the talented employees to stay for longer period. To business man stock options provide an additional offer that is tax advantage which help them from paying tax. Until options are exercised, it is shown as worthless on company's book.

Advantages and Disadvantages of Stock Option | Forex Trading and More Online Opportunities

Technically speakingstock options are in form of a deferred employee compensation but as far as keeping record option disadvantages of employee stock options should be excluded from recording under expense. Stock option helps in showing healthy bottom line and increases the growth of call option binomial model company. When the employees exercise the option, tax deduction is allowed to the company in form of compensation expense which is the difference between strike price and the market price.

Disadvantages of Stock Option After exercising the option to buy, many employees cash out their shares at once as they diversify their personal holdings or lock in gains.

Some of them never hold their share for longer period which is the cause for loosing the motivational value of option. Some employees, as soon as they cash in their option, disappear when they come across a new wealth awaiting another quick score with a new growth company.

Another disadvantage is that the management encourage the employees to take high risk. As far as employees are concerned stock option in form of compensation is an undue risk.

In case of unstable company, if large number of employees try to exercise the option to get profit in the market then there is a chance of collapse in the whole equity structure of a company.

In such case the company must either repurchase stock or increase its earnings which may help in forestalling the dilution of value. Stock MarketStock Trading.

Error (Forbidden)

Minyx Blogger Template distributed by eBlog Templates. Forex Trading and More Online Opportunities.

Advantages and Disadvantages of Stock Option December 5, at 6: After exercising the option to buy, many employees cash out their shares at once as they diversify their personal holdings or lock in gains. Newer Post Older Post Home. Privacy Policy Privacy Policy. Subscribe to My RSS feed Enter your email address: Links Blog Directory blogcatalog.