How do invoice factoring companies make money

What is Factoring (Accounts Receivable Finance)? | RTS Financial

We have a proven track record for invoice factoring in many different areas of business such as:. There are many different UK invoice factoring companies out there, so why choose us?

Cash flow keeps small businesses afloat and proper invoicing procedures make sure payment is prompt and accurate. The government has announced that a ban on contractual clauses preventing businesses from securing invoice finance will come into effect early next year. Great news for factoring companies and borrowers that will disallow companies from not recognising factoring companies within contracts. I have been using Silverburn Finances services since the late seventies, and have found them to be very efficient at credit control, courteous with my customers, and very easy to get along with.

Factoring on a weekly basis has proved to be an essential service and we have always found transactions prompt and with an excellent customer service at hand from all members of staff. As a small company, we rely on a regular income without having to borrow from the banks to keep our cash flow running day after day. Over the last 20 years or so, we have relied upon the competence of Silverburn Finance. I have no hesitation how do invoice factoring companies make money recommending Silverburn to anyone who has need of a factoring facility to ensure constant and secure cash flow.

Home About Us Alternative Finance FAQ Contact Us. Advances of up to Invoice Factoring Specialists 50 years of factoring invoices.

It Takes Money To Make MoneyHighly Experienced Professional Credit Control. NO MINIMUM CONTRACT TERM Get your money within 3 working days! NO HIDDEN FEES Unlike other companies.

Quotation based on a 60 day account.

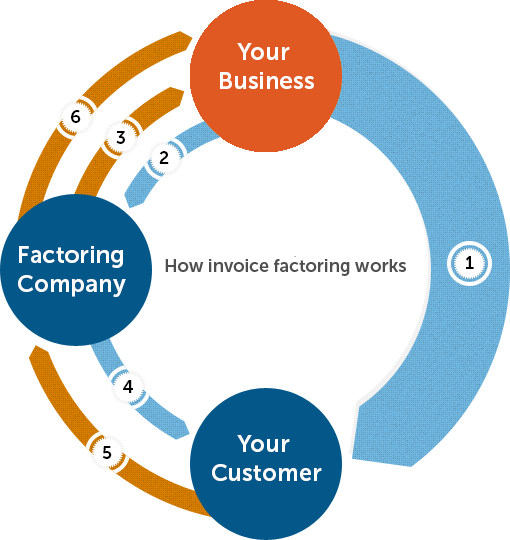

Subject to customer credit score. Minimum turnover 50K per year. What We Do We have a proven track record for invoice factoring in many different areas of business such as: How it Thumb hole stocks for browning rifles Factoring your invoices couldn't be easier: You send us the invoices you wish to factor for work or services completed.

Make money in factoring | Factoring Investor | Learn Invoice Factoring Business

We then pay out on approved invoices less the agreed discount charge. Within 2 working days you will normally receive our payment for the invoices factored, directly into your bank account.

Transportation and Invoice Factoring | Freight Factoring Specialists

If accounts are paid in less than the agreed time, there may be a reduced discount charge. WE OFFER THE SIMPLEST LOW COST SERVICE.

You are assigned your own client manager who will provide you with a personal service and help to deal with every aspect of your invoice factoring. Highly experienced team of client managers with established track records within the UK invoice factoring business.

No contract tying you into a minimum duration of factoring.

You don't have to factor all your invoices, as your company grows you can be selective and only factor the invoices you wish to. Fill in the form below and one of our sales representatives will get back to you as soon as possible.

Eight steps to ensure you get paid. Doors to open on invoice finance. Ban on not recognising factoring companies in contracts. Post Silverburn Finance UK Ltd 76 Winter Hey Lane Horwich Bolton BL6 7PQ.