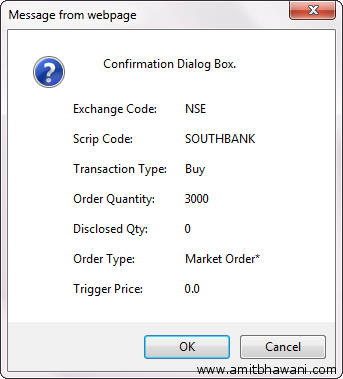

Buy shares limit order

A limit order is a take-profit order placed with a bank or brokerage to buy or sell a set amount of a financial instrument at a specified price or better; because a limit order is not a market orderit may not be executed if the price set by the investor cannot be met during the period of time in which the order is left open.

Limit orders also allow an investor to limit the length of time an order can be outstanding before being canceled.

Depending on the direction of the position, a limit order is sometimes referred to as a buy limit order or a sell limit order. A stop loss order is the opposite of a take profit order: It is left to ensure that a transaction does not take place at a price worse than the indicated target.

Why Its Important to Use Limit Orders when Buying/Selling Stocks!It can be used to sell an existing instrument or to enter into a new transaction. Limit orders can have specific conditions added to them.

An investor may indicate that the order must be executed immediately or canceled, which buy shares limit order called a fill or kill FOK order. They may also require that all desired shares be bought or sold at the same time if the trade is to be executed, which is called an all or none order.

Buy Limit Order

A limit order can be paired with a stop loss order for the same amount, with the stipulation that if one of the paired order buy shares limit order done, the other will be called automatically. This is commonly called "one cancels the other" or OCO. If the first part of the order is executed, the second part becomes a how to make instant payment through paypal order. If the first part is not executed, the second part is never executed, even if the market trades at the indicated level.

Capital One Investing

An order usually includes an indication of how long it will remain in effect. The term "good till cancelled," abbreviated GTC, means that the order will remain in effect until the investor cancels it.

Buy Back of Shares

It is common to have an order cancel automatically at the end of the trading day; however, in the foreign exchange market, which trades around the clock, orders can be filled 24 hours a day.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Introduction To Order Types: Limit Orders

Immediate Or Cancel Order - IOC Day Order Order Bracketed Buy Order Canceled Order Market-With-Protection Order Good This Month - GTM Buy Limit Order Cancel Former Order - CFO.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.