Simple rsi strategy

By Erik Skyba, CMT Senior Market Technician, TradeStation Labs TSLabs TradeStation.

Psychologically, one of the hardest things to do as a trader is to buy the dips in the market. It is very hard to will yourself to buy something that is losing money especially in these times.

The surprising fact is that many discretionary traders on trading desks around the world subscribe to the idea of not chasing prices higher but buying when prices pull back. These traders many times tend to scale into trades. And while I've seen this tactic work in bullish markets, I've also seen it destroy trading desks in bearish markets because no one has unlimited capital. In experiencing these events, I realized that traders were not distinguishing between markets shifts in volatility.

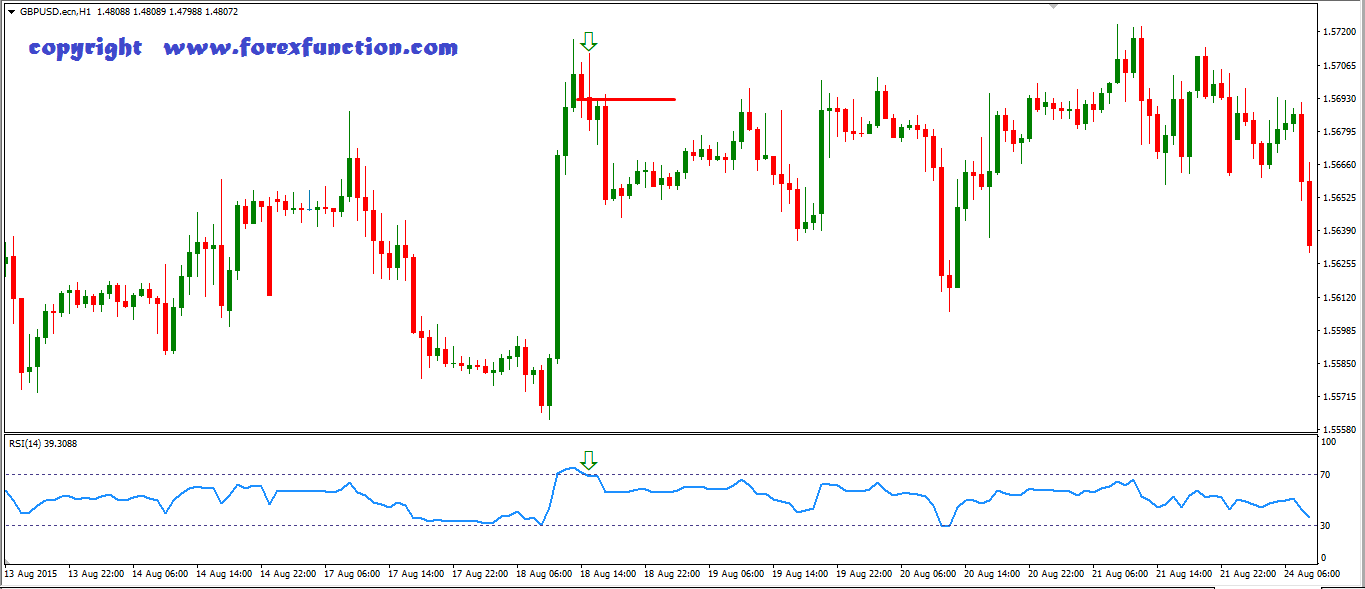

RSI Indicator - How to use RSI with Binary Options Trading?These traders were getting caught in the regime switches of the market. These are periods when average volatility levels change. A modified version of this approach is the Swing 5 - Relative Strength Index Strategy which acts to enter a trade when the security has had a pull back or has experienced some mean reversion.

This pull back is described in the rules of the strategy using the Relative Strength Index, which has a look back window of 5 periods. The strategy employs two separate buy signals based off of two different conditions. Buy Signal 1 is a conditional buy signal that occurs if the close is greater than its day exponential moving average and the Relative Strength Index is less than Buy Signal 2 is another conditional buy signal that has four rules; 1 the close is less than its day exponential moving average; 2 the close is less than the open; 3 the Relative Strength Index is less than 25; 4 the open - close is greater than.

The sell signal for this strategy states that the Relative Strength Index has to be greater than the 40 level. The main idea behind this strategy is that we want to buy the market as it has pull back extremes. We also want our trades to be short term and exit our trades as the Relative Strength Index crosses above In this strategy, we're trying to take advantage of a move to the downside that has gone too far and too fast.

Sellers have panicked pushing prices down and there is no one at least in the short term left to sell. We are also saying just cause 2 money cheat ps3 our rules that the return distribution is more normal above the day exponential moving average so our buy signal 1 is less restrictive.

While the assumption from just our observations is that when the close is below the exponential moving average the distribution of returns is more in the tails and less in the average so we make the rules more restrictive.

This simple rsi strategy not to say that the distribution learn forex in philippines the day exponential moving average cannot be non - normal. As this idea has not been tested yet - it's more of an observation at this point.

Another safety net for these non - normal return events is that the exit criterion is short term, so that you're not in the trade too long just in case the market continues reverting to the downside. Then import the indicators or strategies by double-clicking on the EasyLanguage. This will automatically start the TradeStation import wizard.

The indicators are now available and you can now open the provided workspaces. Can you make money waiting tables supportive documents or files may also be attached to this e-mail. All support, usd inr exchange rate history 2007 and training services and materials on the TradeStation Securities website are for informational purposes and to help customers learn more about how to use the power of TradeStation software and services.

Simple RSI Forex Trading Strategy

No type of trading or investment advice is being made, given or in any manner provided by TradeStation Securities or its affiliates. This material may also discuss in detail how TradeStation is designed to help you develop, test and implement trading strategies. However, TradeStation Securities does not provide or suggest trading strategies.

We offer you unique tools to help you design simple rsi strategy own strategies and look at how they could have performed in the past. While we believe this is very valuable information, we caution you that simulated past performance of a trading strategy is no guarantee of its future performance or success.

We also do not recommend or solicit the purchase or sale of any particular securities or derivative products. Any symbols referenced are used only for the purposes of the demonstration, as an example not a recommendation.

Simple RSI strategy backtest in R (quantmod, quantstrat) - Freelance Job in Quantitative Analysis - $50 Fixed Price, posted May 16, - Upwork

Finally, this material may discuss automated electronic order placement and execution. Please note that even though TradeStation has been designed to automate your trading strategies and deliver timely order placement, routing and execution, these things, as well as access to the system itself, may at times be delayed or even fail due to market volatility, quote delays, system and software errors, Internet traffic, outages and other factors.

Call a TradeStation Specialist Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Options trading is not suitable for all investors.

Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. View the document titled Characteristics and Risks of Standardized Options. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Neither the Company, nor any of its associated persons, registered representatives, employees, or affiliates offer investment advice or recommendations. The Company may provide general information to potential and prospective customers for the purposes of making an informed investment decision on their own. All proprietary technology in TradeStation is owned by TradeStation Technologies, Inc.

Equities, equities options, and commodity futures products and services are offered by TradeStation Securities, Inc. Skip to main content Skip to main navigation. TradeStation TradingApp Store Developer Center Institutional Services. Chatting With A TradeStation Representative. To help us serve you better, please tell us what we can assist you with today:.

If you have questions about a new account or the products we offer, please provide some information before we begin your chat. If you are a client, please log in first.

RSI And How To Profit From It

Education TradeStation Labs Analysis Concepts Swing 5 — Relative Strength Index Strategy. Morning Market Briefing Analysis Concepts Traders Interviews Events. Check the background of TradeStation Securities, Inc. Sitemap Contact Us About Us FAQ Terms of Use Security Center Privacy Policy Customer Agreements Other Information Careers.