Do cash dividends decrease retained earnings

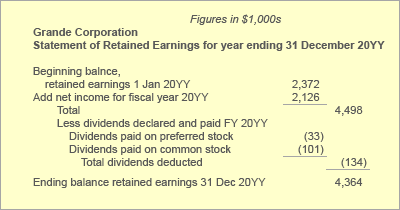

When a company issues a cash dividend to its shareholders , the retained earnings listed on the balance sheet are reduced by the total amount of the dividends paid. A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment.

Companies are not required to issue dividends on common shares of stock, though many companies pride themselves on paying consistent and increasing dividends each year. However, dividends issued to preferred shareholders are set a certain rate at share issuance and are guaranteed each year. If a company wants to issue dividends to common shareholders , preferred shareholders must receive their guaranteed dividends first. When most people think of dividends, they think of cash dividends as described above.

However, companies can also issue stock dividends. When a company issues a stock dividend , it distributes additional shares of stock to existing shareholders according to the number of shares they own. One hundred shares, therefore, become The term retained earnings refers to the amount of money a company has that is not used for other purposes.

While the net profit reflects the amount of income that remains after accounting for the cost of doing business in a given year, retained earnings refers to the amount accrued over the years that has not been reinvested in the business or distributed to shareholders. When a dividend is issued, retained earnings are depleted by the total value of the dividend.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How do dividends affect retained earnings? By Claire Boyte-White September 2, — 2: Stock Dividend When most people think of dividends, they think of cash dividends as described above.

What Are Retained Earnings? The Accounting When a dividend is issued, retained earnings are depleted by the total value of the dividend.

Do Cash Dividends Declared Affect the Retained Earnings Statement? | The Finance Base

The purpose of dividends is to return wealth back to the shareholders of a company. There are two main types of dividends: Find out if stocks can pay dividends monthly, and learn about the types of companies most likely to do so and how monthly Learn how dividends are accounted for and why cash or stock dividends on common or preferred shares are not considered an Learn how different types of dividends, such as cash dividends and stock dividends, affect a company's balance sheet, based Understand the basics of collecting dividend payments on ordinary shares, including when dividends can be paid and under Find out how dividends affect the price of the underlying stock, the role of market psychology and how to predict price changes after dividend declaration.

Seven words that are music to investors' ears? Dividends may seem like money for nothing, but they have several implications. Understanding dividends and how they work will help you become a more informed and successful investor. Learn about the four most common reasons a company may choose to suspends its dividends, including financial trouble, funding growth and unexpected expenses. Find out how dividends affect a company's stockholders' equity and how the accounting process changes based on the type of dividend issued.

How do dividends affect retained earnings? | Investopedia

A distribution of a portion of a company's earnings, decided An estimation of a year's dividend expressed as a percentage Money paid to stockholders, normally out of the corporation's An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.