Covered calls options ex les

The covered call strategy is an excellent strategy that is often employed by both experienced traders and traders new to options.

Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy.

You will need to be approved for options by your broker prior to using this strategy, and it is likely that you will need to be specifically approved for covered calls. Read on as we cover this option strategy and show you how you can use it to your advantage.

Options Basics Options Basics For those who are new to options, let's review some basic options terminology. A call option gives the buyer the right, but not the obligation, to buy the underlying instrument in this case, a stock at a predetermined price the strike price on or before a predetermined date option expiration. Each option contract you buy is for shares. The amount the trader pays for the option is called the premium.

There are two values to the option, the intrinsic and extrinsic value , or time premium. The intrinsic value is also referred to as the option's moneyness. It is often said that professionals sell options and amateurs buy them. Option sellers write the option in exchange for receiving the premium from the option buyer. They are expecting the option to expire worthless and, therefore, keep the premium. For some traders, the disadvantage of writing options naked is the unlimited risk.

You Make Me Sic - TV Tropes

When you are an option buyer, your risk is limited to the premium you paid for the option. But when you are a seller , you assume unlimited risk.

Cut Down Option Risk With Covered Calls

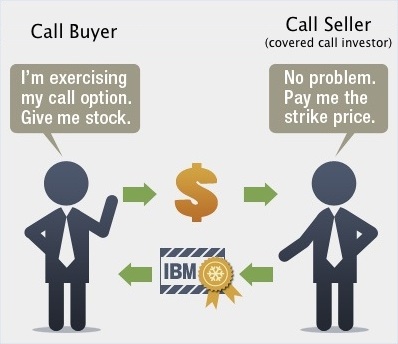

Refer back to our XYZ example. The seller of that option has given the buyer the right to buy XYZ at Clearly, the more the stock's price increases, the greater the risk for the seller. How Can a Covered Call Help? In the covered call strategy, we are going to assume the role of the option seller. However, we are not going to assume unlimited risk because we will already own the underlying stock.

This gives rise to the term "covered" call--you are covered against unlimited losses in the event that the option goes in the money and is exercised. The covered call strategy is twofold. First, you already own the stock. It needn't be in share blocks, but it will need to be at least shares. You will then sell, or write, one call option for each multiple of shares i.

When using the covered call strategy , you have slightly different risk considerations than you do if you own the stock outright.

American Ex-Prisoners of War Organization

You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. If the stock goes lower, you are not able to simply sell the stock; you will need to buy back the option as well.

When to Use a Covered Call There are a number of reasons traders employ covered calls. The most obvious is to produce income on stock that is already in your portfolio. Others like the idea of profiting from option premium time decay , but do not like the unlimited risk of writing options uncovered. A good use of this strategy is for a stock that you might be holding and that you want to keep as a long-term hold, possibly for tax or dividend purposes.

You feel that in the current market environment, the stock value is not likely to appreciate, or it might drop some. As a result, you may decide to write covered calls against your existing position. Alternatively, many traders look for opportunities on options they feel are overvalued and will offer a good return. To enter a covered call position on a stock you do not own, you should simultaneously buy the stock and sell the call.

Remember when doing this that the stock may go down in value. In order to exit the position entirely, you would need to buy back the option and sell the stock.

What to Do at Expiration Eventually, we will reach expiration day. What do you do then? If the option is still out of the money, it is likely that it will just expire worthless and not be exercised. In this case, you don't need to do anything. If you still want to hold the position, you could " roll out " and write another option against your stock further out in time. Although there is the possibility that an out of the money option will be exercised , this is extremely rare.

If the option is in the money, you can expect the option to be exercised. Depending on your brokerage firm, it is very possible that you don't need to worry about this; everything will be automatic when the stock is called away. What you do need to be aware of, however, is what, if any, fees will be charged in this situation. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will be profitable.

Let's look at a brief example. You can then continue to hold the stock and write another option for the next month if you choose. The Bottom Line The covered call strategy works best for the stocks for which you do not expect a lot of upside or downside. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. Also, always remember to account for trading costs in your calculations and possible scenarios.

Like any strategy, covered call writing has advantages and disadvantages. If used with the right stock, covered calls can be a great way to reduce your average cost.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Cut Down Option Risk With Covered Calls By Chad Butler Share. Learn how this simple options contract can work for you, even when your stock isn't. Trading options is not easy and should only be done under the guidance of a professional. While writing a covered call option is less risky than writing a naked call option, the strategy is not entirely riskfree.

Learn how to buy calls and then sell or exercise them to earn a profit. Investing with options can be a great strategy, but you need to do your research first or the risks can outweigh the benefits. Options offer alternative strategies for investors to profit from trading underlying securities, provided the beginner understands the pros and cons. Learn more about stock options, including some basic terminology and the source of profits.

Discover the option-writing strategies that can deliver consistent income, including the use of put options instead of limit orders, and maximizing premiums. Futures contracts are available for all sorts of financial products, from equity indexes to precious metals. Trading options based on futures means buying call or put options based on the direction Learn how option selling strategies can be used to collect premium amounts as income, and understand how selling covered Learn how aspects of an underlying security such as stock price and potential for fluctuations in that price, affect the An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.