Nifty option lot size

A futures contract is a forward contract, which is traded on an Exchange.

Lot sizes reduced for various NSE F&O Contracts « Z-Connect by Zerodha

NSE commenced trading in index futures on June 12, The index futures contracts are based on the popular market benchmark CNX Nifty index. Selection criteria for indices.

NSE defines the characteristics of the futures contract such as the underlying index, market lot, and the maturity date of the contract. The futures contracts are available for trading from introduction to the expiry date. The underlying index is CNX NIFTY. NIFTY futures contracts have a maximum of 3-month trading cycle - the near month one , the next month two and the far month three.

A new contract is introduced on the trading day following the expiry of the near month contract. The new contract will be introduced for a three month duration. This way, at any point in time, there will be 3 contracts available for trading in the market i. CNX Nifty futures contracts expire on the last Thursday of the expiry month. If the last Thursday is a trading holiday, the contracts expire on the previous trading day.

The value of the futures contracts on Nifty may not be less than Rs. Download the file for permitted lot size. Base price of CNX Nifty futures contracts on the first day of trading would be theoretical futures price..

The base price of the contracts on subsequent trading days would be the daily settlement price of the futures contracts.

In respect of orders which have come under price freeze, members would be required to confirm to the Exchange that there is no inadvertent error in the order entry and that the order is genuine. On such confirmation the Exchange may approve such order.

The applicable quantity freeze limit shall be based on the level of the underlying index as per the following table:. Download the file for quantity freeze. An option gives a person the right but not the obligation to buy or sell something.

An option is a contract between two parties wherein the buyer receives a privilege for which he pays a fee premium and the seller accepts an obligation for which he receives a fee.

The premium is the price negotiated and set when the option is bought or sold.

A person who buys an option is said to be long in the option. A person who sells or writes an option is said to be short in the option. NSE introduced trading in index options on June 4, The options contracts are European style and cash settled and are based on the popular market benchmark CNX Nifty index.

CNX Nifty options contracts expire on the last Thursday of the expiry month. The Strike scheme for all near expiry near, mid and far months Index Options is:. The Strike scheme for Nifty long term Quarterly and Half Yearly expiry option contracts is:. The value of the option contracts on Nifty may not be less than Rs. Base price of the options contracts, on introduction of new contracts, would be the theoretical value of the options contract arrived at based on Black-Scholes model of calculation of options premiums.

The options price for a Call, computed as per the following Black Scholes formula: Natural logarithms are based on the constant e 2. Rate of interest may be the relevant MIBOR rate or such other rate as may be specified. The base price of the contracts on subsequent trading days, will be the daily close price of the options contracts. The closing price shall be calculated as follows:.

Equity Futures and Nifty span margin calculator - Zerodha Margin Calculator

If the contract is not traded for the day, the base price of the contract for the next trading day shall be the theoretical price of the options contract arrived at based on Black-Scholes model of calculation of options premiums. The higher the Percent of Deliverable Quantity to Traded Quantity the better - it indicates that most buyers are expecting the price of the share to go up. Selection criteria for indices NSE defines the characteristics of the futures contract such as the underlying index, market lot, and the maturity date of the contract.

Contract Specifications Security descriptor The security descriptor for the CNX Nifty futures contracts is: Date of contract expiry Instrument type represents the instrument i.

Underlying symbol denotes the underlying index which is CNX Nifty Expiry date identifies the date of expiry of the contract Underlying Instrument The underlying index is CNX NIFTY. Trading cycle NIFTY futures contracts have a maximum of 3-month trading cycle - the near month one , the next month two and the far month three.

Trading Parameters Contract size The value of the futures contracts on Nifty may not be less than Rs. Base Prices Base price of CNX Nifty futures contracts on the first day of trading would be theoretical futures price..

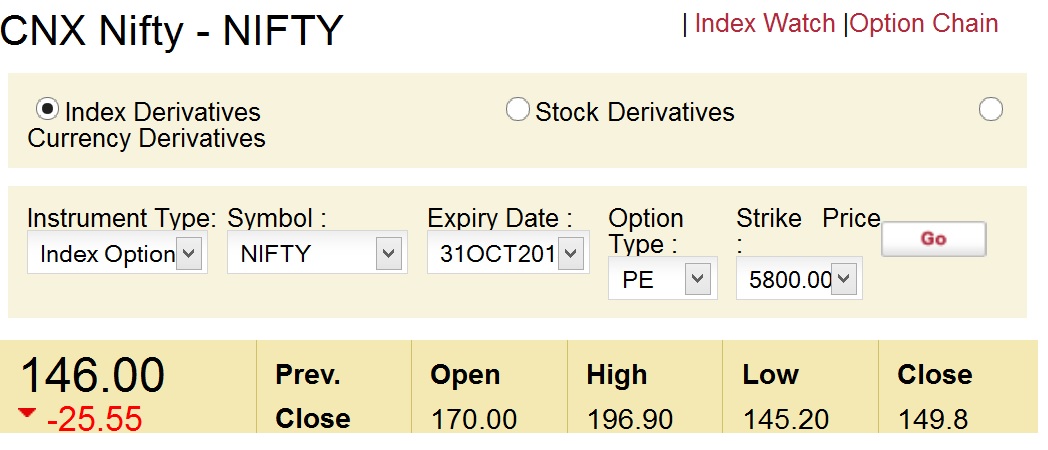

Live Options | Nifty Options | Live Option Charts

Quantity freeze The applicable quantity freeze limit shall be based on the level of the underlying index as per the following table: Selection criteria for indices Contract Specifications Security descriptor The security descriptor for the CNX Nifty options contracts is: Date of contract expiry Option Type: Strike price for the contract Instrument type represents the instrument i. Underlying symbol denotes the underlying index, which is CNX Nifty Expiry date identifies the date of expiry of the contract Option type identifies whether it is a call or a put option.

Underlying Instrument The underlying index is CNX NIFTY. Expiry day CNX Nifty options contracts expire on the last Thursday of the expiry month.

Strike Price Intervals 1. The Strike scheme for all near expiry near, mid and far months Index Options is: The Strike scheme for Nifty long term Quarterly and Half Yearly expiry option contracts is: Base Prices Base price of the options contracts, on introduction of new contracts, would be the theoretical value of the options contract arrived at based on Black-Scholes model of calculation of options premiums.

The closing price shall be calculated as follows: If the contract is traded in the last half an hour, the closing price shall be the last half an hour weighted average price. If the contract is not traded in the last half an hour, but traded during any time of the day, then the closing price will be the last traded price LTP of the contract.

Related Links Watch the market live! Equities Stock Watch Charts Map of the Market Get real-time market analyses! Verifying your trades Registering a complaint Getting NSE certification Did You Know The higher the Percent of Deliverable Quantity to Traded Quantity the better - it indicates that most buyers are expecting the price of the share to go up.