Hedging forex currency

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy. It is a very common type of financial transaction that companies conduct on a regular basis, as part of doing business. Companies often gain unwanted exposures to the value of foreign currencies and the price of raw materials.

As a result, they seek to reduce or remove the risks that come with these exposures by making financial transactions. In fact, financial markets were largely created for just these kind of transactions - where one party offloads risk to another. An airline might be exposed to the cost of jet fuel, which in turn correlates with the price of crude oil.

Foreign currency risk management in today’s volatile currency environment: PwC

Companies will hedge in various markets, to offset the business risks posed by these unwanted exposures. This would protect the company against the risk of increased costs from a rise in the price of oil.

When the futures contracts expire, the company would take physical delivery of the oil and pay in US dollars. Therefore, there's a strong likelihood that the company would also choose to hedge its risk in foreign exchange. As an individual, you may find yourself in a position where foreign exchange hedging might be an attractive option.

For example, let's say you live in the UK and have invested in Nintendo shares, sitting on a healthy profit after the success of Pokemon Go.

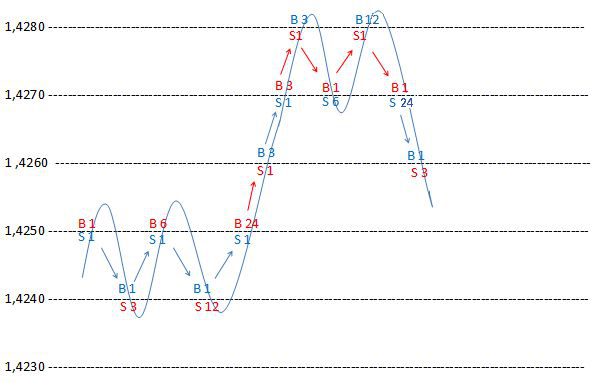

If you are interested in doing something like this, try it out yourself with MT4 Supreme Edition. Now, continuing with our scenario - what if you wanted to keep hold of your shares in the hope of running your profits further? You might be happy to run such an exposure, hoping to make additional profit from the yen strengthening. The amount you make from your foreign exchange risk hedging, should offset the negative impact of the weaker Yen on your equity trade.

In reality, there is the complication that the currency risk fluctuates as the value of the shares changes. But, there may be times where you may only want to temporarily or partially reduce your exposure. Let's look at another example - say that you hold several FX positions ahead of the Brexit vote.

Overall you are happy with these as long-term positions, but you are worried about the potential for volatility in GBP going into the Brexit vote. Rather than extricating yourself from your two positions with GBP, you decide instead to hedge. Alternatively, you might hedge some smaller amount than this, depending on your own attitude to risk.

Another, slightly less direct way of hedging a currency exposure is to place a trade with a correlated currency pair. The Correlation Matrix that comes bundled with MetaTrader 4 Supreme Edition , allows you to view the correlation between different currency pairs. If you find a currency pair that is strongly correlated with another, it is possible to construct a position that is largely market neutral.

What Is Forex Hedging?

The concept of combining correlated positions in order to offset risk, is where Forex hedge funds originally got their name. If you are interested in trying to construct a market neutral strategy, you can experiment risk free with our Demo Trading Account. But if the market moves in your favour, you make less than you would have made without the hedge.

Learn more about How to use a Forex hedging strategy to look for lower-risk profits. Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using Admiral Markets UK Ltd services please acknowledge the risks associated with trading.

The content of this Website must not be construed as personal advice. Admiral Markets UK Ltd recommends you seek advice from an independent financial advisor. Admiral Markets UK Ltd is fully owned by Admiral Markets Group AS.

Admiral Markets Group AS is a holding company and its assets are a controlling equity interest in Admiral Markets AS and its subsidiaries, Admiral Markets UK Ltd and Admiral Markets Pty. All references on this site to 'Admiral Markets' refer to Admiral Markets UK Ltd and subsidiaries of Admiral Markets Group AS.

Admiral Markets UK Ltd. Clare Street, London EC3N 1LQ, UK. About Us Why Us?

Regulatory Authorisation Admiral Markets UK Ltd is regulated by the Financial Conduct Authority in UK. Contact Us Leave feedback, ask questions, drop by our office or simply call us.

Partnership Enhance your profitability with Admiral Markets - your trusted and preferred trading partner. Careers We are always on the lookout to add new talent to our international team. Press Centre Get the latest Admiral Markets press releases and find our media contacts in one place, whenever you want them Order execution quality Read about our technologies and see our monthly execution quality report.

Account Types Choose an account that suits you best and start trading today. Top products Forex Commodities Indices Shares Bonds. Contract Specifications Margin requirements Volatility Protection. Learn more about this plugin and its innovative features. MT4 WebTrader Use MT4 web trading with any computer or browser no download necessary.

Fundamental Analysis Economic events influence the market in many ways. Find out how upcoming events are likely to impact your positions. Technical Analysis Charts may show the trend, but analysis of indicators and patterns by experts forecast them. See what the statistics say. Forex Calendar This tool helps traders keep track of important financial announcements that may affect the economy and price movements. Autochartist Helps you set market-appropriate exit levels by understanding expected volatility, impact of economic events on the market and much more.

Trader's Blog Follow our blog to get the latest market updates from professional traders.

Foreign exchange hedge - Wikipedia

Market Heat Map See who are the top daily movers. Movement on the market always attracts interest from the trading community. Market Sentiment Those widgets help you see the correlation between long and short positions held by other traders.

Learn the basics or get weekly expert insights. FAQ Get your answers to the frequently asked questions about our services and financial trading. Trader's Glossary Financial markets have their own lingo. Learn the terms, because misunderstanding can cost you money. Held by trading professionals. Risk Management Risk management can prevent large losses in Forex and CFD trading. Learn best-practice risk and trade management, for successful Forex and CFD trades.

Zero to Hero Start your road to improvement today. Our free Zero to Hero program will navigate you through the maze of Forex trading. Forex Have you ever fancied giving trading a go? Check out our free online Forex education course and learn to trade in just 3 steps!

Admiral Club Earn cash rewards on your Forex and CFD trading with Admiral Club points. Play for fun, learn for real with this trading championship. Personal Offer If you are willing to trade with us, we are willing to make you a competitive offer.

About Us About Us Why Us? What is Forex hedging and how do I use it? Android App MT4 for your Android device. MT4 WebTrader Trade in your browser. MetaTrader 5 The next-gen.

MT4 for OS X MetaTrader 4 for your Mac. Forex and CFD trading may result in losses that exceed your deposits. Please ensure you understand the risks involved.

Regulatory Authorisation Contact Us News Testimonials Partnership Careers Press Centre Order execution quality. Products Forex Commodities Indices Shares Bonds Contract Specifications Margin requirements Volatility Protection. Platforms MetaTrader 4 MT4 Supreme Edition MT4 WebTrader MetaTrader 5. Analytics Fundamental Analysis Technical Analysis Wave Analysis Forex Calendar Autochartist Trader's Blog Market Heat Map Market Sentiment.