How to trade spreads in futures

Trading grain futures can be a trying experience for both new and experienced traders. There are many factors that can affect price action that are unpredictable and have little to due with fundamental or technical market factors. Volatility in the markets due to the activity of hedge funds and index funds as well as daily fluctuations in world currencies can have a major impact on price action.

For background information on trading grain futures, read Grow Your Finances In The Grain Markets. Spread markets, on the other hand, are seldom affected by action in world currency markets and are generally more true to fundamental market factors.

Futures Calendar Spread | Basics Of Trading Futures Calendar Spreads

A huge move, up or down, due to outside market factors will likely affect the action of a spread very little relative to the outright futures price. This is why many grain traders prefer to trade spreads rather than trading outright futures contracts. Let's take a look at the calendar spread in particular to show you why investors flock to these fields.

To really understand options and futures, check out our Option Basics and Futures Fundamentals tutorials. Calendar Spread A calendar spread in the grain markets, or any futures market, involves buying a futures contract in one month and selling one in a different month for the same commodity. Traders will buy July futures while simultaneously selling November futures or vice versa in order to take advantage of changes in the relationship between the two contract months.

Traders participating in this spread trade care very little about the price of the outright futures market and only care about the spread relationship. In most cases, money will be lost in one leg of the spread but made in another leg of the spread. In a successful spread, the gains in one leg will obviously outweigh the losses sustained in the losing leg. This is sometimes a very difficult concept for new traders to grasp. The type you choose to initiate will depend on various factors - which are outlined below.

Introduction to Futures Spread Trading | icoqerum.web.fc2.com - SA

For more information on this type of investment strategy, read Pencil In Profits In Any Market With A Calendar Spread. Supply And Demand Calendar spreads are generally affected by supply and demand factors rather than money flow or outside influences. The difference in prices is known as the " cost of carry ". This amount includes the costs of insurance, interest and storage of physical grain, or the dollar amount required to "carry" grain from one month to another.

Spreads will not trade past the cost of full carry , generally. For example, the cost to store, insure and pay interest on a bushel of corn for one month is about 6.

Basic Concepts of Spread TradingSince this is the entire cost required, the spread between July and December corn should not move past cents 6. In most cases, spreads will only trade at full carry if there is ample physical supply of the given commodity.

In contrast, spreads will often trade at an inverse if there are low supplies of a commodity. This would mean that nearby contract months would be trading above deferred months in order to ration demand and maintain acceptable supplies. This scenario has taken place many times over the years in the corn, soybean and wheat markets. Learn how to interpret supply and demand from USDA reports in Harvesting Crop Production Reports.

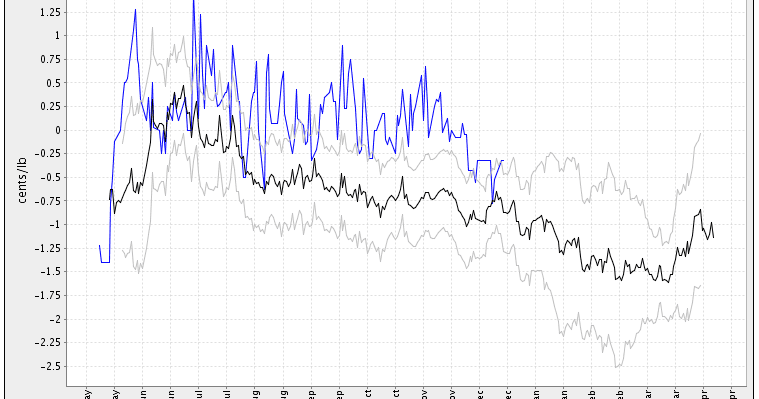

Analysis Once the basic concept of the spread is known, traders can begin to perform their own analysis of certain spread markets and identify opportunities. When looking at a given spread, traders should gather certain information before taking action. What has the relationship been historically?

Look at the past 15 years and see where the spread has gone seasonally and in situations with similar fundamentals. Most knowledgeable brokers will be able to you provide you with historical spread charts. Use this information to determine which type of spread to initiate. If a spread generally moves higher through a particular seasonal time frame, traders should be more willing to initiate a bull spread.

If a spread tends to move lower seasonally, traders should be more willing to initiate a bear spread. Learn about gauging market changes in Digging Deeper Into Bull And Bear Markets. Conclusion Examine the supply situation for the given commodity and determine if any demand rationing will need to take place. A commodity that has low supplies relative to past years and a wide spread would be a good target for bull spreaders, especially if the spread tends to work seasonally.

The opposite could be said for commodities with historically high supply levels. More detailed analysis will then take place. All factors involving supply and demand will affect spread markets. A good spread trader will constantly monitor everything from production potential to exports or even trendlines.

This combination of fundamental and technical analysis helps spread traders to grasp what is driving the given spread relationship, and decide which spread to trade and how to trade it. Dictionary Term Of The Day.

Spread trading: Tricks of the trade | Futures Magazine

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Trading Calendar Spreads In Grain Markets By Joseph Vaclavik Share.

There are two basic types of spreads that are relevant here: It's very important for every investor to learn how to calculate the bid-ask spread and factor this figure when making investment decisions. Writing bull put credit spreads are not only limited in risk, but can profit from a wider range of market directions. Learn why option spreads offer trading opportunities with limited risk and greater versatility. Spread betting is a speculative practice that began in the s as a way for gamblers to win money on changes in the line of sporting events.

But by , the phenomenon trickled into the financial Spread betting can be fun, but it's risky and you will want a reliable broker. Here are the top spread betting brokers. The temptation and perils of being over leveraged is a major pitfall of spread betting. However, the low capital outlay necessary, risk management tools available and tax benefits make spread Knowing which option spread strategy to use in different market conditions can significantly improve your odds of success in options trading.

Find out more about option spread strategies, and how to set the strike prices for bull call spreads and bull put spreads Find out which factors influence bid-ask spread width. Learn why some stocks have large spreads between bid and ask prices, Learn about debit and credit option spread strategies, how these strategies are used, and the differences between debit spreads Learn how financial spread betting is done, and see examples of some of the ways that investors can use spread betting as Learn about financial spread betting, the risks involved with spread betting and the dangers of placing financial spread An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.