How to transfer stocks from one brokerage to another

At times, investors transfer their securities accounts between broker-dealers. While the process generally runs smoothly for the vast majority of the thousands of accounts transferred each year, there are times when delays occur and investors pose questions.

In an effort to help investors better understand the account transfer process, we are issuing this educational information to provide some basic facts about the account transfer process. Most customer accounts are transferred between broker-dealers through an automated process.

The National Securities Clearing Corporation NSCC operates the Automated Customer Account Transfer Service ACATS to facilitate the transfer of a customer account from one broker-dealer to another.

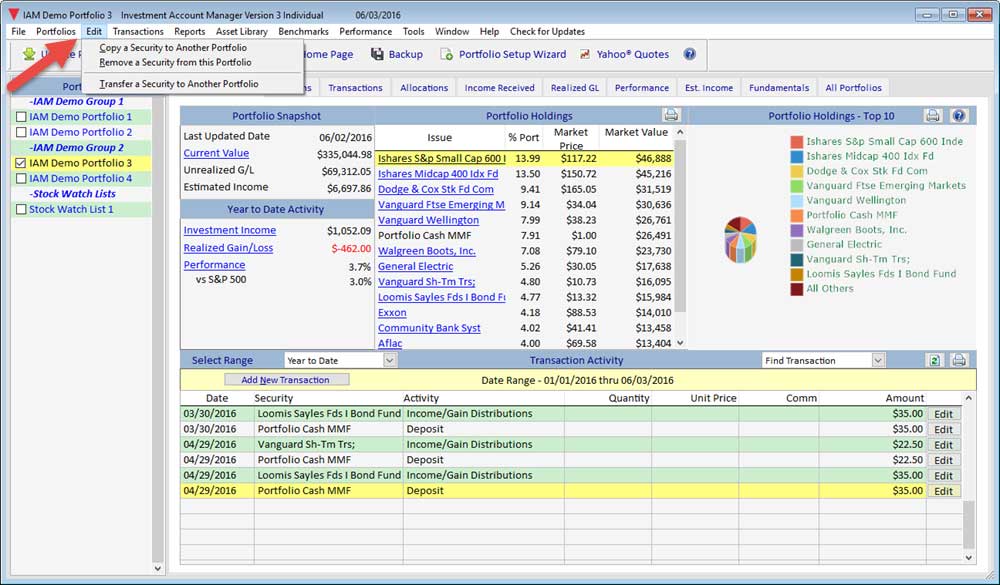

Transfers involving the most common assets, for example, cash, stocks and bonds of domestic companies, and listed options, are readily transferable through ACATS. Individuals wanting to transfer their securities account from one broker-dealer to another initiate the process by completing a Transfer Initiation Form TIF and sending it to the firm to which they want to transfer their account.

The firm a customer is transferring the account to can provide the form to facilitate the transfer.

Error (Forbidden)

The new firm is called the "receiving firm. Although automated, the account transfer process is somewhat complicated and is impacted by certain factors and regulations, the most important of which are discussed below.

Once the receiving firm obtains the TIF, it enters certain customer data, including the name on the account, Social Security number, and account number at the delivering firm into ACATS. Shortly after the data is entered, an automated function permits the delivering firm to see that a request to transfer the account has been made.

If the account request is rejected, the new firm may correct the data from that which it originally entered or it may have to contact the customer to make sure the information on the TIF form is correct.

Once the customer account information matches, the transfer request is considered to be validated. In most cases, the validation process will take about three business days to complete once the new firm enters the request into ACATS. Once the transfer request is validated, the delivering firm will send a list of the assets in the account to the receiving firm via ACATS.

The receiving firm will review the list of assets to decide whether it wishes to accept the transfer of the account. It is important for investors to recognize that broker-dealers are not required to open or accept the transfer of an account and can decide which investments they choose to accept. In this regard, a customer might initiate a transfer request only to find that the new firm has declined to accept the account.

For example, the new firm may decide not to accept the account due to the quality of securities supporting a margin loan, or because the account does not meet its minimum equity requirements. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm.

This is called the delivery process. In total, the validation process and delivery process generally take about six days to complete. Factors that may result in additional time needed to transfer an account.

Generally, transfers where the delivering entity is not a broker-dealer for example a bank, mutual fund, or credit union will take more time. In addition, transfers of accounts requiring a custodian, like an Individual Retirement Account or a Custodial Account for a minor child, may take additional time. Many events, as described above, occur simultaneously during the account transfer process. Prior to moving accounts from one firm to another, it is always a good idea to review and understand the transfer process.

How do you transfer common stock from one broker to another? | Investopedia

In addition, communicate with the new firm and determine whether any specific policies or constraints might impact the transfer of your account. For example, if you have a margin account, you should ask if the new firm will accept a margin account and, if so, what are its minimum requirements.

In short, make sure the intended new firm is a good fit for you before you attempt to transfer the account. In addition, investors can become familiar with the account transfer process by discussing it with the new firm.

Ask questions, like the anticipated length of the transfer process given the specific type of account such as cash, margin, IRA, custodial and the assets held such as stocks, bonds, options, limited partnership interests. Inquire about anything that may cause a delay during the account transfer process. Ask how the firm informs customers that the transfer process is complete? Investors should also consider that buying and selling securities during the account transfer process often complicates and delays the transfer.

As a result, investors are best served if they avoid trading during the transfer process.

For example, if ABC security is a volatile stock and you are concerned about not being able to sell your stock during the transfer process, you should consider selling ABC before entering the transfer request. Get Rid of Debt Save for Retirement Get Help with a Broker Dispute Control Spending Start an Emergency Fund Save for College Deal with Losing a Job Deal with Identity Theft Protect My Employees From Scams.

FINRA Home About FINRA Newsroom Contact Site Preferences. How are accounts transferred between broker-dealers?

What must a customer do to start the account transfer process? What is involved in the account transfer process? Receiving Firm Review Once the transfer request is validated, the delivering firm will send a list of the assets in the account to the receiving firm via ACATS.

Time Frames Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. Factors that may result in additional time needed to transfer an account Generally, transfers where the delivering entity is not a broker-dealer for example a bank, mutual fund, or credit union will take more time. What are realistic expectations of the time that is required to transfer an account?

What can a customer do to ensure that the account transfer is successful? Office of the Ombudsman.

File a Regulatory Tip. Overview Initiate an Arbitration or Mediation Information for Arbitrators Information for Mediators. ABOUT FINRA Leadership FINRA Locations Careers Contact. FINRA is a registered trademark of the Financial Industry Regulatory Authority, Inc.