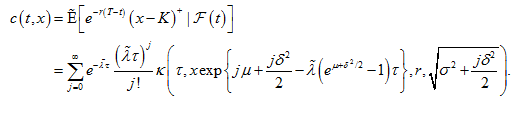

Pricing stock options in a jump diffusion model with stochastic volatility and interest rates

Our site uses cookies to improve your experience. You can find out more about our use of cookies in About Cookies , including instructions on how to turn off cookies if you wish to do so. By continuing to browse this site you agree to us using cookies as described in About Cookies.

Black Scholes Options Pricing Model (BSOPM)Mathematical Finance Volume 7, Issue 4 , Version of Record online: Options for accessing this content: If you are a society or association member and require assistance with obtaining online access instructions please contact our Journal Customer Services team. If your institution does not currently subscribe to this content, please recommend the title to your librarian.

Pricing Stock Options in a Jump-Diffusion Model with Stochastic Volatility and Interest Rates: Applications of Fourier Inversion Methods - Scott - - Mathematical Finance - Wiley Online Library

Login via other institutional login options http: You can purchase online access to this Article for a hour period price varies by title If you already have a Wiley Online Library or Wiley InterScience user account: Please register, then proceed to purchase the article. Login via OpenAthens or Search for your institution's name below to login via Shibboleth.

Registered Users please login: Access your saved publications, articles and searches Manage your email alerts, orders and subscriptions Change your contact information, including your password Click Here to Login.

Save publications, articles and searches Get email alerts Get all the benefits mentioned below!