Vanguard emerging markets stock index fund review

March 13, By The Money Wizard 17 Comments. With so many options, it can feel like throwing darts at a board. Choosing the right type of fund is important stuff, and can mean the difference of several hundreds of thousands of future dollars. Like all complicated life decisions, we can break index fund investing down into a few easy steps:. You can take a look at the full table yourself here.

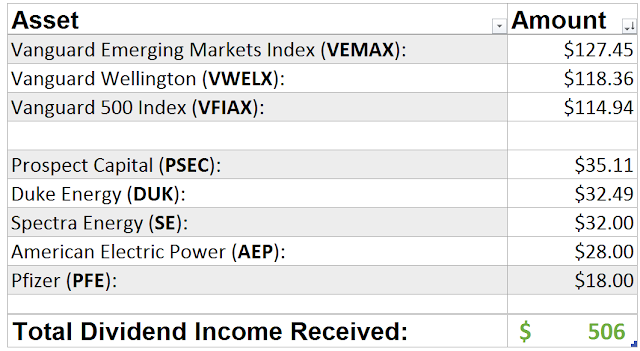

The one big, huge, noticeable difference between index funds? The expense ratio is the overall cost to run the fund. So in the above example with 0. And are usually just investing in index funds anyway. This is the yearly fixed income you can most likely expect to earn from a given fund. For stock funds, this is the average dividend yield. For bond funds, this gets slightly more complicated, but in general, it represents the approximate fixed income distributions an investor can expect.

Remember that investing is cyclical, and what goes up can and often does! Investor shares funds do have slightly higher expense ratios, but overall the fees for any Vanguard fund are still crazy, unbelievably low.

Why are we only looking at admiral shares funds? This post is filled with a bunch of snapshots direct from the Vanguard website, but do keep in mind that all of these asset classes should be available at any other reputable broker.

These funds invest in bonds or other forms of debt. At their core, bonds are just IOUs from businesses to investors. As interest on the debt is collected, investors in bond funds receive fixed income. Bonds are less risky than stocks, and bond investors generally like the above mentioned fixed income potential. Normally, bond prices and stocks should move in opposite directions, making bonds an excellent tool for diversification. Because US government bonds aka treasury bonds are backed by Uncle Sam himself, these funds present the least amount of risk and therefore lower yields.

Investment grade bonds have a slightly higher risk of default than say, the U. Most investment grade bond funds invest in corporate bonds. Think bonds from your General Electrics, Hewlett-Packards, ATTs, and UPS. By investing in municipal bonds, tax exempt bond funds can provide income exempt from federal income tax. A pretty sweet deal, although I typically ignore these funds since I sadly do not make enough money for the tax exemptions to really be worth my time.

Large cap investors love the idea of putting their money to work with big, safe, mature companies. This section includes many different mixes and options.

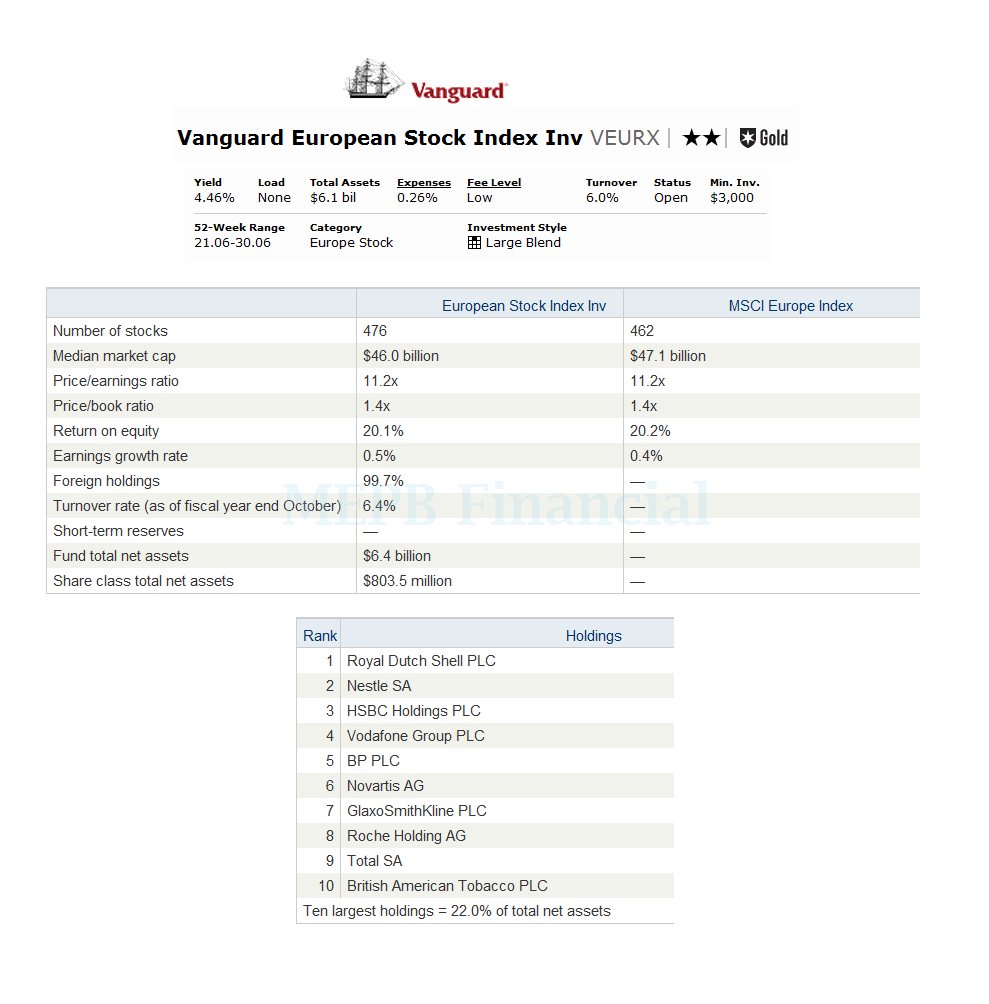

Here are some funds and terms to familiarize yourself with:. Again, Vanguard offers a number of mid cap funds to choose from, including Mid-Cap Value, Mid-Cap Growth, and an overall Mid-Cap Index. With small caps, you could be looking at your next Chipotle or your next Qumu. International Funds can provide diversification in addition to what is available in a U.

In theory, a country halfway across the world could experience booming years while our own markets stagnate, although some recent research shows an increasing correlation between all countries as our world becomes more global. And there ya go! So, where to from here? How many funds should I have? What about asset allocation? An index fund, by nature, consists of thousands of parts, which means that even if some of the stocks or bonds within the fund tank, vanguard emerging markets stock index fund review rest are there to pick up the slack.

Want to keep it absolutely, unbelievable simple? VTSAX the Total Stock Market Index Fund we talked about earlier and calling it a day. And most of these companies also have significant business overseas. Lots of other investors much smarter than I do the same: Wanting a little more excitement, or exposure to another asset class?

Consider reducing volatility with a larger position in bonds, whose worst decline in the past 25 years was just 2. I like the Total Bond Market Index VBMFX. In a world of chaos, false salesmen, and wild speculation, an index fund strategy is one of the safest paths to riches. March 13, at 8: Thanks for the guide! I do like that we have options though. The Money Wizard says. March 13, at March 13, at 3: Nothing but good things to say about the company, low fees, and ease of managing our own accounts.

This is a good article for those starting out, Vanguard is the best. One of the original index funds investors! March 13, at 7: Thanks for the tips! I had been stockpiling some money for the past few months wow mop leatherworking money making wanted to get into Index Funds on Vanguard, but I was initially overwhelmed with all the choices.

How to Choose a Vanguard Index Fund - My Money Wizard

Thank you for the simplification. Question, why does the SEC yield differ from the annual rate of return so much?

I would think it would be the same. Yet there is a huge difference according to your explanation. I am currently making decisions for a K plan. These occur no matter what stock prices are doing. Asset appreciation meaning changes to the price of a stock.

Imagine instead of a stock or index fund you have a rental house. Now to add more questions on top of the many you receive. Thanks for the help!

Can Vanguard's New Emerging-Markets Fund Beat Its Own Index Fund?

At $100 sign up bonus and earn money for read email end of the day, tax advantages means more money in your pocket… eventually… so I personally max out the Roth before I start contributing to my after tax index funds.

March 14, at 4: Is there any way to invest if you training day film trailer italiano not from the US?

March 21, at 1: March 14, at 6: Behind does simple words I can tell a well knowledgeable financial person. From early on I am a big Vanguard fan for all the reason you had given. March 18, at March 25, at 8: You know, Apple, the company that had to install nets around its sweatshops to keep employees from jumping from the top of said sweatshops to their deaths, because the working conditions are so miserable.

And whose phone manufacturing process is known to turn rivers milk-white? How do they get to stand on a moral high ground while a company selling beers is immediately blacklisted? Screening all companies for alignment with your own moral code seems difficult at best and impossible at worst.

Plus, at lot of these socially responsible funds are just a clever way to prey on investor guilt and charge higher fees. Offering forex metatrader broker reviews 10, at 4: How do you feel about investing with robo-advisors like Wealthfront and Betterment which offer diversification in low cost ETFs, automatic portfolio re balancing and tax loss harvesting for a.

Your email address will not be published. Become a Money Wizard! Get the latest articles and inside scoop sent right to your inbox. Notify me of follow-up comments by email. My Money Wizard Demystifying the Magic of Personal Finance.

Home About Net Worth Blog Archives Recommended LendEdu Review SoFi Review Get Paid to Shop Online Contact.

And 55 more ETFs?? Like all complicated life decisions, we can break index fund investing down into a few easy steps: And are usually just investing in index funds anyway 2 SEC Yield: Bond Funds These funds invest in bonds or other forms of debt. Vanguard has a host of bond funds. Warning, and overwhelming number of options coming: These are your least risky bond funds.

Investment Grade Bond Funds: Tax Exempt Bond Funds By investing in municipal bonds, tax exempt bond funds can provide income exempt from federal income tax. Stock Funds Again, a long list of options which we can break down by category: Here are some funds and terms to familiarize yourself with: Value investing refers to purchasing temporarily depressed or undervalued companies, and hoping those companies eventually climb back up in value.

Bank of America during the financial crisis is an example of a value investment. Growth investing is all about finding companies with above average potential for expansion.

Imagine Apple after the hype of a new iPhone, or Tesla prior to a press release about world changing technology. Total Stock Market Index: The Grand Daddy of Diversification.

You may recognize this name from my monthly Net Worth Updates. A few terms to familiarize yourself with: Here you are looking at more stability in exchange for less rapid return potential. These carry more risk and volatility, but also a chance for higher growth. Vanguard does this by investing in both developed and emerging markets all over the globe.

Time to Get Diversifying And there ya go! And another … Wanting a little more excitement, or exposure to another asset class?

That should help smooth the ride for you. When in doubt, keep it simple. Should You Trade Individual Stocks? Don't worry, I hate spam just as much as you do.

Picky Pincher says March 13, at 8: I hope this article will keep people from missing out. The two differ because the SEC Yield is only one of two components adding to your annual return.

Any thoughts on the best socially responsible funds? Leave a Reply Cancel reply Your email address will not be published.

After watching most of my friends start down a quick path to financial destruction, I created the Money Wizard community to share everything I've learned so far and to interact with others interested in reaching financial wizardy. Become a Money Wizard Save Thousands on Student Loans 10 questions, 3 minutes, no commitment, and no effect on your credit score. Check out the number one tool used by Money Wizards for comparing student loan refinancing rates: Most Popular Posts Who is The One Percent?

Categories Book Reviews Cars Debt Early Retirement Featured Go Figure Investing Link-O-Rama Millennials Money Money Hacks Net Worth Random Thoughts Real Estate Saving Money Student Loans The Money Wizard Travel Working.