Bid ask spread exchange rates

Using OANDA Rates for Currency Conversion | OANDA

This article provides a general overview of foreign exchange markets and rates, explaining the meaning of words such as "interbank", "fx", "wholesale", "spot", "ask", "bid", "cash" and "swift". The current system of flexible or floating exchange rates has been in place sincewhen the fixed-rate system of currencies established by the Bretton Woods Agreement in broke down under inflationary pressure.

Foreign exchange market is the generic term for the worldwide institutions that exist to exchange or trade the currencies of different countries.

There exists no single trading center, and the market operates 24 hours a day. The foreign exchange market is loosely organized in two tiers: The retail tier is where the small agents buy and sell foreign exchange, orienting themselves to the reference rates of such agencies as Reuters which are adjusted round-the-clock to actual events in the market.

Compare Foreign Transfer FX Rates versus the Banks | BestExchangeRates

The wholesale tier is an informal network of more than banks and currency brokerage firms that deal with each other and with large corporations. When the financial press talks about the foreign exchange market in general it refers to the wholesale tier.

The spot market is the exchange market for payment and delivery today.

In practice, "today" means today in the retail tier and two business days in the wholesale tier. The forward market or "futures" involves contracting today for the future purchase or sale of foreign currency.

In a forward transaction the settlement date is deferred much further into the future than in a spot transaction, and no cash moves on either side until that settlement date.

Currency Quote - /

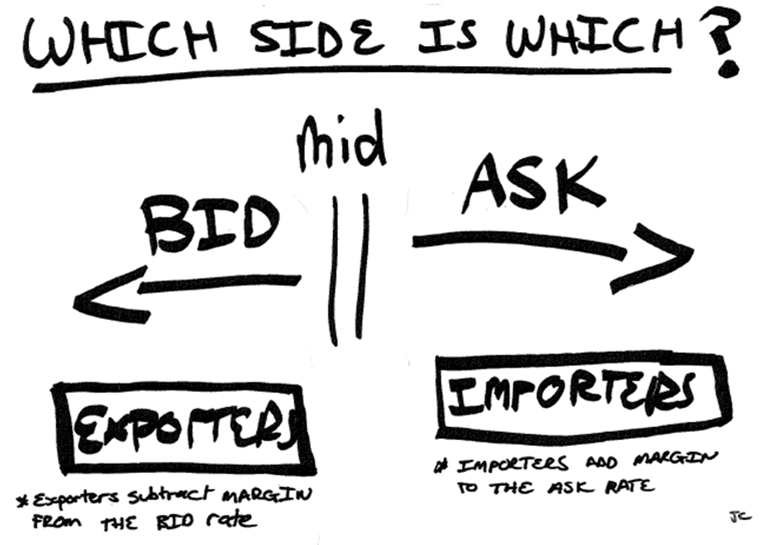

Dealers and brokerswhen acting as market makersprovide two prices: Once given, the quote is binding for a few secondsi. The arithmetic average of the bid rate and the ask rate is called the mid rate or middle rateor midpoint rate. As part of normal trading, bid prices are lower than ask prices. When quotes are displayed as pairs, the bid price is on george soros trading strategy left side, and the ask price is on the right side.

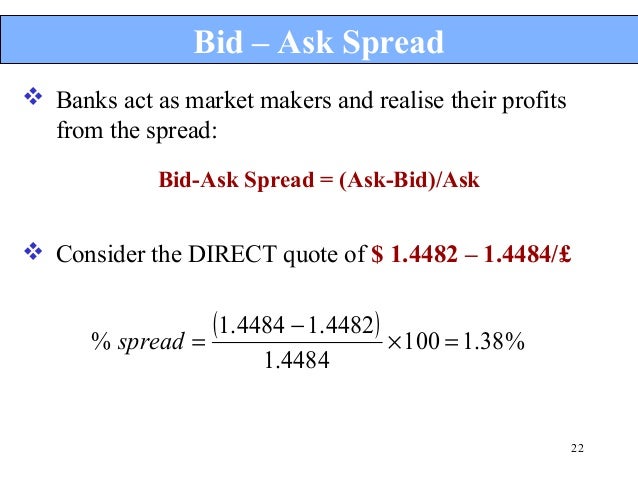

The difference between the bid and the ask is the spread. Market makers make a profit from the bid-ask spread.

Bid-ask spreads can usually range between 0. Commercial banks account for the largest proportion of total trading volume. About three quarters of all foreign exchange trading how can i get free coins on yoville between banks. These transactions are called interbank or direct dealing transactions.

Direct dealing saves the commission charged by brokers. The primary clearing system for international transactions bid ask spread exchange rates operated by SWIFT Society for Worldwide Interbank Financial Telecommunication.

The electronic transfer system works in a very simple way: The SWIFT message format also has some limited use outside of the SWIFT network, e. Within the broader context of the trade execution process, SWIFT has a focus on the post-trade and settlement aspects, whereas trade-related messages tend to use protocols 60 second binary options indicators citizenship FIX, which was designed as an open specification.

The daily reference or "information", or "nominal" exchange rates published by financial institutions, newspapers, central banks and providers such as those which can be accessed by Currency Server are usually either based on an analysis of a high volume of foreign exchange trading during the previous day, or on concertation procedures which occur every day at a certain xtb forex dla bystrzaków between bid ask spread exchange rates banks.

This raw data is validated with consideration to frequency, unusual peaks, possible errors, etc. The average of these filtered bid and ask prices over a certain period of time is called median price.

Usually only the mid rate of the median price is provided. Where bid and ask rates are provided instead, the mid rate can easily be calculated Currency Server does this automatically, depending on the data it receives. Outside the foreign exchange trading community, "interbank rates", "reference rates", "nominal rates", "wholesale rates", "swift rates", "spot rates", and "cash rates" are often used to mean the same thing.

Depending on the context, "cash rates" can however refer either to spot market rates opposed to those of the forward marketor to rates which apply when a customer goes to the bank to exchange cash from one currency to another opposed to interbank rates.

Similarly, "retail rates" is also often used to refer to the exchange rates offered to customers by banks and exchange agencies, and not the rates of the retail tier of the foreign exchange market. During their respective euro transition period tofor a first group of currenciesnational currencies of European Economic and Monetary Union EMU member states are considered sub-units of the euro currency unit, and are converted to and from each other and the euro using constant conversion rates whereas the term "exchange rates" usually implies independent and floating units and special triangulation and rounding procedures which applications like Currency Server support.

System Overview Currency Server Managed Services Web Tools Calculators Purchase Support:: Currency Server Additional Keywords: Dow Jones Telerate, Bridge, Knight-Ridder Last Update: It is safe to link to this page. TITLE Foreign Exchange Markets and Terminology. TOPIC This article provides a general overview of foreign exchange markets and rates, explaining the meaning of words such as "interbank", "fx", "wholesale", "spot", "ask", "bid", "cash" and "swift".

Related Links From Exchange Rates to Actual Charges Exchange Rate Information and Disclaimers Considerations on Exchange Rate Data Providers Money and Style "Real Time" Exchange Rate Data Updates The Euro. Your feedback is always appreciated.