Adaptive bollinger bands

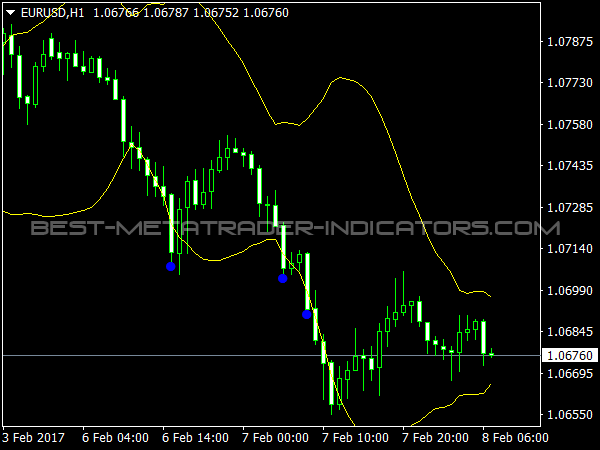

Adaptive Bollinger Bands is an advanced Bollinger Bands technical indicator for MT4 Forex trading. Adaptive Bollinger Bands can change the look back period dynamically based on current Forex market condition. Adaptive Bollinger Bands adapts to the Forex market changes as much as possible.

Adaptive Price Zone Technical Indicator Explained

Adaptive Bollinger Bands is more advanced than conventional Bollinger Bands. Try before you buy! Adaptive Bollinger Bands changes the look back period dynamically basing on smartly designed adaptive methods. No worry about fixed period any more.

Bollinger Bands Trading StrategyThe six adaptive methods are Volatility, Fractal, Swing, Symmetry ZigZag, Up Down Balance, and Variable. All methods can be configured separately. Simple SMA , exponential EMA , smoothed SMMA , linear weighted LWMA , volume weighted VWMA , double EMA DEMA , and triple EMA TEMA. The seven price types, close, open, high, low, median, typical, weighted, and John Ehlers RSI smoothing are supported.

Adaptive Bollinger Bands is much more sensitive to Forex market condition changes than conventional Bollinger Bands. Adaptive Bollinger Bands automatically detects the best look back period to adapt to the current Forex market conditions. The signal arrows can be displayed on the bar chart.

Don't miss any trade opportunity. Support mobile push notification. The indicator value will not change after a bar completes. The indicator doesn't cheat, it works honestly for you.

Adaptive Bollinger Bands indicator MT4 - Software Infocard Wiki

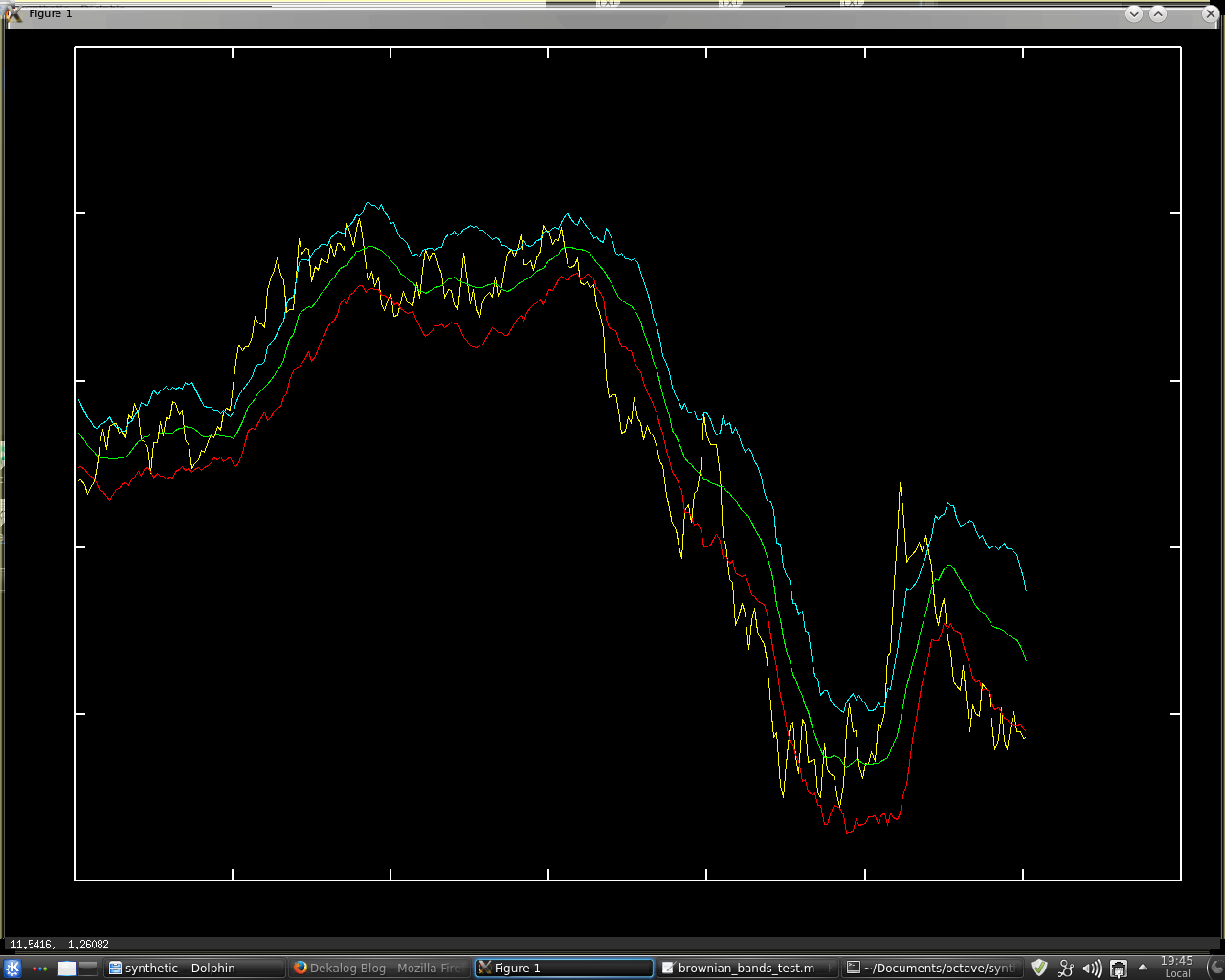

The blue line is the standard Bollinger Bands 1. The red line is Adaptive Bollinger Bands with volatility based look back. Want to see more screenshots? Click to view more! There are six adaptive methods in Adaptive Bollinger Bands, all works in the similar way.

In ranging, sideways, swing, choppy, and oscillating market, the look back period tends to be shorter.

In trending market, the period tends to be longer. The stronger trend, the longer period. The weaker trend, the shorter period.

With this mechanism, in trending market, Adaptive Bollinger Bands is less likely to change its direction so we can ride on the trend for longer time. And in ranging market, Adaptive Bollinger Bands will change its direction more often so that we can either catch the upcoming trend early or catch each reversals in the market.

Since Adaptive Bollinger Bands is more sensitive to market condition change than conventional Bollinger Bands, Adaptive Bollinger Bands is a better indicator for detecting over bought and over sold. It should be used together with other indicators or price action.

More strategies are waiting for you to research. All methods work the similar way but the underlying algorithm is quite different. Read this blog to learn how to enable DLL in MT4. The DLL used in Adaptive Bollinger Bands indicator is as safe as all other MT4 indicators written in MQL. The DLL only accesses data in MT4 sandbox. There are 6 adaptive methods in the indicator.

I have to say, the price of Adaptive Bollinger Bands is too inexpensive, and the price may raise in the future. The power of programming and algorithm trading. Overview Buy Download Document Discussion Adaptive Bollinger Bands indicator for MetaTrader 4 Forex technical trading Adaptive Bollinger Bands is an advanced Bollinger Bands technical indicator for MT4 Forex trading. Dynamic look back period Adaptive Bollinger Bands changes the look back period dynamically basing on smartly designed adaptive methods.

More sensitive to market Adaptive Bollinger Bands is much more sensitive to Forex market condition changes than conventional Bollinger Bands. True market driven Adaptive Bollinger Bands automatically detects the best look back period to adapt to the current Forex market conditions. Shows buy and sell signal arrows The signal arrows can be displayed on the bar chart.

No repaints, no recalculation The indicator value will not change after a bar completes. Displays the look back The look back periods are displayed in Adaptive Bollinger Bands.