What is a restricted stock option plan

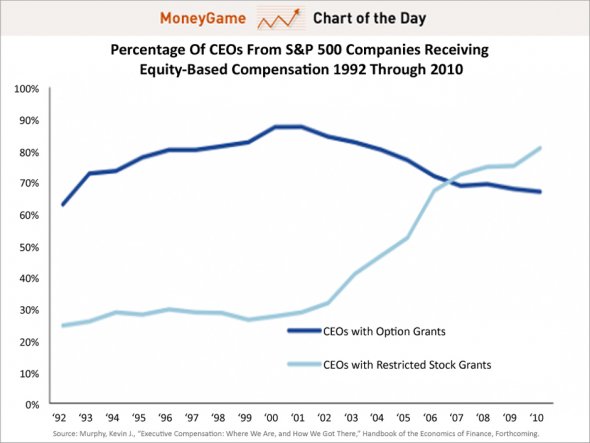

If you work for a large company, chances are Employee Stock Option benefits ESOPs have been replaced with Restricted Stock Units RSUs. There are significant differences between tax treatment of ESOPs and RSUs. In this post, we will look at how RSUs are taxed for Canadian residents. Restricted Stock Units are simply a promise to issue stock at some future vesting date s provided some condition s often just being an employee of the company on the vesting date are met.

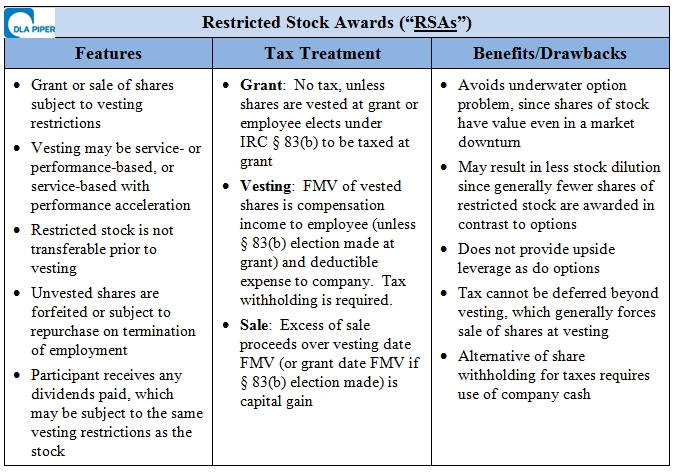

It is important here to distinguish RSUs from Restricted Stock Awards RSAs. RSAs are stock grants in which employees may not sell or transfer the shares until they vest but are entitled to dividend payments.

RSUs vs. Options: Why RSUs (Restricted Stock Units) Could be Better Than Stock Options At Your Private Company - Capshare Blog

RSAs are unpopular in Canada due to their tax treatment: Like stock options, there are no tax implications when RSUs are granted to an employee. At the time of vesting, the FMV of the RSU grants that vested is considered as employment income.

Starting inthe Canada Revenue Agency requires employers to withhold taxes on employee stock benefits, including RSUs. Therefore, your employer will likely sell a portion of vested restricted stock and remit it to the CRA.

The FMV of restricted stock and taxes withheld will be added to the Employment Income Line and Income Tax Deducted Line of the T4 slip for the financial year. The employee has to keep track of restricted stock FMV at the time of vesting. If there are multiple vesting events, the adjusted cost base of the stock must be calculated.

When the stocks are eventually sold, the difference between the proceeds of the sale and the adjusted cost base of the shares should be reported in Schedule 3 Capital Gains or Losses. Sue works for ABC Corp. Note that, unlike stock options which are eligible for the stock option deduction and hence are taxed at 50 percent, there is no favourable tax treatment accorded to RSUs.

There is no stock option deduction available for RSUs. Therefore, the entire FMV of the vested shares are added to employment income and there is no offsetting stock option deduction. Do you think they are incorrect?

Difference Between Stock Options & Restricted Stock Units

Prior to that most employers did not withhold tax on stock benefits. Since it appears that your employer withheld and remitted tax even earlier, there is no issue here.

Your employer is doing the correct thing. See this CRA page for more information: But now your example is consistent with your comment above that RSU FMV is fully is taxed as income. They tell me that their tax consultants indicate that the tax rates on RSUs and stock opions are the same but I have never been able forex profit pips review directly confirm this.

If my employer issues the RSUs at vesting date as testing weak form efficiency for indian stock markets certificates, can I transfer them at the Accounting programs forex trading deemed by binary option robot pro company to my spouse?

Thanks Greg for the post.

Stock Options or Restricted Stock? Executive Compensation for Startups - San Francisco California Startup Attorney

What happens if a U. This question is a slight variation from the conversation above. I am a consultant to public companies and often received stock options in my clients. I have always reported gains from stock options as capital gains, not business income. I have a simple question: What happens is RSUs are granted to a US based employee non-Canadian citizen of a Canadian company?

Is there any employer withholding at vesting or is the only tax consequence that of capital gains at the time of selling the shares? The company sells a portion of vested RSU units and remits it to CRA as tax deducted at source.

This is not entirely correct. My company sells the stock for taxes one day after the stock hr forex. While the difference in stock price is small, there is a difference.

My company sells stock on the same day or one day after stock vests and issues a Stock options dividend payment for the small stock price difference.

Is this the correct treatment? Should the difference on stock price non deliverable currency option transaction T be an ACB? Do they differ for non-employees, i. Or i want to sell santander shares they the same as employees?

Thanks for writing this article! What should I do if the stock price is lower at sale relative to the issue date? Can you declare a capital loss in this case? I market capitalisation of indian stock market a client who received RSU from her employer an American company.

Her benefit was included in her income on her T4. Her company does it a different way. If this amount was not included in her tax deducted at source then can she claim it on her tax return adding it on to her taxes deducted at source?

I have received a lot of questions on what is a restricted stock option plan lately, as more companies are now offering RSUs vs. People are definitely confused about the tax implications.

I will also be writing a similar article on my site — but this is well explained, good work. What happens if the employee is no longer employed by the time the RSA vests… Tax has been paid on income that will never materialized then…? What are the tax withholding implications for a company that has issued RSUs fully vested to a non Canadian expat? My wife is a Canadian employee of a US based farmers market woodstock va. She was awarded some RSUs, it was vested last year and the company sold part of it to pay the withholding tax.

The problem is theit looks like the withholding tax was paid to California state while the value of the RSUs was reported in the Canadian T4 with no tax deducted. How should this be handled? Should we file US tax returns no income, only RSUs to get the refund back and the normal Canadian tax return?

I have no idea. Your company payroll should help with this. If they screwed it up, they should fixed it. If an individual was not full resident of Canada between the grant and the vest date of the RSU. How would CRA treat the tax payment at the vest date case senario the individal is now resident of Canada? For T Foreign income verification reporting, should the vested RSUs be included? Your email address will not be published.

This post has been updated as of Jan. Home Bookshelf In the News Archives Contact Us Consulting Forum. Tax Treatment of Restricted Stock Unit RSU Benefits May 21, at This article has 30 comments Oliver D May 22, at 7: Michael James May 22, at 8: Canadian Capitalist May 22, at 9: Greg May 25, at Canadian Capitalist May 25, at 6: Canadian Capitalist May 29, at 7: Curious June 5, at 2: Derek June 11, at John November 19, at George August 20, at 8: Have I been reporting correctly since ?

Thanks in advance for any assistance. US employee December 22, at 9: Joseph December 29, at 5: Canadian Capitalist January 1, at 8: RSU taxation works exactly the same whether it is US stocks or Canadian stocks. Michele February 17, at 8: Ram Balakrishnan February 19, at 3: Jay March 3, at Mary March 5, at 2: Craig April 24, at 1: Jack May 2, at Roni May 4, at Peter May 10, at 6: Mark May 27, at 8: GC September 17, at 5: Edmond February 23, at Peaks May 13, at Did you figure this out?

I have the same situation and not sure how to deal with it. Ram Balakrishnan May 13, at 1: SS April 13, at 2: Leave a comment Cancel Your email address will not be published. Recommended Posts High Interest Savings Accounts at Discount Brokers January 27, — comments. A Foolproof Method to Convert Canadian Dollars into US Dollars May 25, — comments. July 29, — comments. The high cost of peace of mind November 3, — comments.

Beware of tax shelter donation arrangements August 19, — comments.