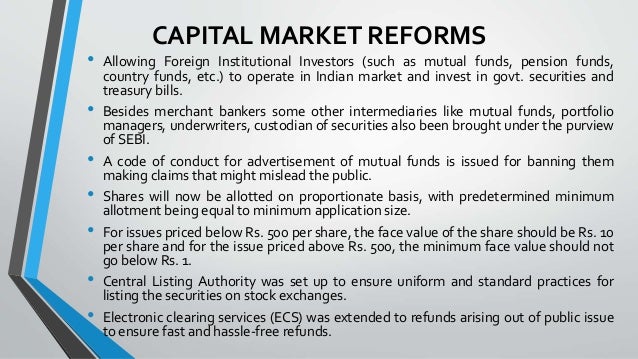

Capital market reforms sebi

Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Our dedicated team comprises of competent people with extensive knowledge and experience. Office-1st Floor Rattan Jyoti Building 18, Rajendra Place, New Delhi The team consists of distinguished chartered accountants, corporate financial advisors and tax consultants.

The firm represents a combination of specialized skills, which are geared to offers sound financial advice and personalized proactive services. Those associated with the firm have regular interaction with industry and other professionals which enables the firm to keep pace with contemporary developments and to meet the needs of its clients.

Download Free WEBTEL ALERTS on your Mobile FREE Android Mobile App for Instant Alerts of Due Dates, Important Updates of Income TaxService TaxCo. Indepthh studyy of existing systems, procedures and controls for proper understanding.

Registration under Service tax, Consultancy for maintenance of proper records, Consultancy for proper accounting for Incorporation of company, Consultancy on Company Law matters, Planning for Mergers, Acquisitions, De-mergers Preparation of Monthly Salary Sheet, Deductions as per applicable laws like Income Tax, Provident Fund, Professional Governance Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Our Team Our dedicated team comprises of competent people with extensive knowledge and experience.

Contact Us Office-1st Floor Rattan Jyoti Building 18, Rajendra Place, New Delhi Adhia Seeks to bring certain sections of the CGST Act, into force w. No plans to link Aadhaar with property details Start-ups: Electronics, lifestyle goods get cheaper Ministers to clear GST doubts after roll-out GST registration for businesses to reopen on June 25 GST: FM Late roll-out rumours rile government Jewellery, tractor makers to gain from revised GST UIDAI asks agencies to prioritise mobile updation for GST Airline Cos may Push up Fares to Lighten GST Load Aadhaar Must to Avail Govt Contribution for APY GST Roll-out Preparations Take Off on War Footing No Centralised Registrations for Banks Under GST: FinMin One Nation, One Tax Dept: Bandaru Dattatreya GST, Note Ban to Formalise Indian Economy: Govt Have a tax rate that disincentivises cigarette smuggling: P2P Lending Startups Face Funding Woes Insolvency Resolution Time for Smaller Cos may be Shortened I-T Dept Launches New Facility to Link Aadhaar with PAN Note ban effect: Jaitley GSTN enrolment halts; to restart later Need to Hand Incentives to Foreign Arms Cos: Taxpayers Surge by a Crore States Asked Not to Accept Cash Payments for Electricity Bills GST rates likely to be fixed by weekend Aadhaar for PAN to check black money: CEA Banks can't refuse scribbled notes, says RBI circular Ind directors are not independent: Sebi chief Big Rate Changes Unlikely under GST: I-T lens on 60, depositors GST: Hasmukh Adhia Council to finalise rules for new tax regime today GST to hit shadow economy: Focus now on rules, specific rates Govt services, office freebies may attract GST RBI: IT prosecution action triples in FY17 Parliament passes Enemy Property Bill EPFO exempts S'pore citizens from mandatory PF contributions Attention taxpayers: CBDT to taxmen Labour reforms may get going, finally SMS for Week ended Updated Till: Have any Query Click Here.

Audit Services Indepthh studyy of existing systems, procedures and controls for proper understanding. Income Tax Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Service Tax Registration under Service tax, Consultancy for maintenance of proper records, Consultancy for proper accounting for Accounting Services Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Corporate Services Incorporation of company, Consultancy on Company Law matters, Planning for Mergers, Acquisitions, De-mergers Payroll Preparation of Monthly Salary Sheet, Deductions as per applicable laws like Income Tax, Provident Fund, Professional Webtel Get in Touch.

Home Team Contact Us News Query. Useful Links Income Tax Dept. Contact Us Office-1st Floor Rattan Jyoti Building 18, Rajendra Place, New Delhi 30 Lines We feel happy to talk contact carajeev. Read More Our Team Our dedicated team comprises of competent people with extensive knowledge and experience.

Read More Contact Us Office-1st Floor Rattan Jyoti Building 18, Rajendra Place, New Delhi Govt notifies 18 sections 2 rules for new tax regime. Anti profiteering authority can deregister firms. Regulator to ease norms to expedite insolvency process. Seeks to bring certain sections of the CGST Act, into force w. Border checkposts may not end soon as e-Suvidha, e-Sangam to remain.

CBDT comes out with secondary adjustment rules. No plans to link Aadhaar with property details. Govt eases paperwork norms. Seeks to exempt persons only engaged in making taxable supplies, total tax on which is liable to be paid on reverse charge basis. Midnight Parliament Central Hall event to mark GST roll-out. SMS for Week ended 18th June Public shareholders could find it easier to become promoters. India Inc gets GST filing breather for 2 months.

Sebi to ease FPI norms, fast-track IPO listings. Transitioning tax credits under GST. Investors are willing to bear GST pain for long-term gains. Sebi May Make Acquisition of Distressed Assets Stress-Free. Relaxation in return filing procedure for first two months of GST implementation. India ready for GST, anti-profiteering rules soon, says revenue secretary.

Now, Aadhaar must for opening bank accounts. New digital policies soon. IBBI notifies norms for fast-track insolvency resolution for start-ups. CBDT forms task force for a unified IT assessment. Sebi ups penalty for non compliance. Karnataka Assembly passes state GST Bill.

Govt asks builders to pass on GST benefit to buyers. GSTN Registrations Set to Open for Ecomm Vendors. Bankruptcy Bill gets Cabinet nod. Sebi issues norms on margin trading facility. Electronics, lifestyle goods get cheaper. Ministers to clear GST doubts after roll-out. GST registration for businesses to reopen on June Banks may Stop Gold Imports on Own Account. Sebi to ease entry norms for FPIs. Sebi Allows Options in one commodity per exchange. TDS rule not for multiple tenants.

Retailers want FMCG firms to cut prices after GST roll-out. Late roll-out rumours rile government. Jewellery, tractor makers to gain from revised GST.

UIDAI asks agencies to prioritise mobile updation for GST. Airline Cos may Push up Fares to Lighten GST Load. Aadhaar Must to Avail Govt Contribution for APY. GST Roll-out Preparations Take Off on War Footing. No Centralised Registrations for Banks Under GST: Govt Examines Duty Drawback Benefit Schemes in GST Regime. Drug inventory with stockists falls ahead of new tax regime. GST Council reduces rates of 66 products. FinMin debating bad bank, basic income proposals: Sebi mulls ways to check fraudulent tax benefits via stocks.

MSME units can nowfile GST grievances online. Traders can now everify GST registration via OTP. GST Council to examine rate concerns of traders. Simplifying safe harbour rules.

SMS for Week ended 11th June GSTN has 50 days to take off, says CEO. Safe harbour tax rules eased to coax MNCs. Bullion trade plea on new problems. Taxmen to Dig into Cases of Spike in Income under Revised Returns. Sebi Body Wants Review of Position Limits for Commo Futures.

RBI seen keeping rates unchanged but softening its hawkish stance. Portal to Facilitate FDI Proposals Soon. Mandatory National Licence for Staffing Firms in Works. Abolished cesses to pave way for GST. GSPs put up brave face amidst roll out uncertainties. India signs pact to check DTAA abuse. GST transition stock norms eased. RBI tightens norms for masala bond issuances. Insolvency code could take time to resolve cases.

EPFO extends deadline for submitting Aadhaar to June Ministries to decide on FDI proposals within 60 days: One Nation, One Tax Dept: I-T Takes Cue from GST.

Genuine Transactions Won't Get Caught In Tax Tangle. Now, universal minimum wage for workers to be reality soon. CAG will audit GSTN, says Finance Minister Jaitley. Footwear manufacturers rue high tax, dual rates. COAI Seeks GST Rate Cut Citing Sectoral Ill-Health. Extension of due date for furnishing Form Unfinished agenda to keep GST Council busy till roll-out. No IGST on Imports Under Export Promotion Schemes. Textile Exporters' Bodies Welcome Fixing of GST Rates.

India, Germany Plan Pact to Help Startups Thrive. ICAI proposes joint audit for private banks. Tax refund on stocks without invoice may go up. I-T warns against cash dealings of Rs 2 lakh, seeks tip-off. Andhra wants lower tax rates on tractors, fertilisers. Corporate governance panel set up. I-T dept sets eyes on benami assets acquired in past 3 yrs. Industry's last chance to register for GST. Aadhaar Data Gets New Security Guards. GST unfairly equates amusement parks with casinos, race course.

Reform measures to broaden tax base, cut debt. GST Council will give final shape to new tax framework tomorrow. Sebi asks banks to explain bad loan under-reporting.

Delhi Assembly passes goods and services tax Bill. Exporters, importers need to quote GSTIN from July 1. Link Aadhaar with PAN using SMS: Ordinance to forex vs emas teeth to anti-profiteering clause.

GST The Road Ahead - Ahead of GST Rollout, Banks Struggle with IT Woes. Modi what to buy binary options Review GST Groundwork.

Sebi puts in place disclosure norm for green bonds. Not ruling out rationalisation of GST rates: New Re1 notes to be circulated soon. Norms on Commo Options in a Fortnight. Karnataka Assembly to ratify GST Bill capital market reforms sebi June 5 session. Sebi cracks the whip on p notes.

Labour reforms will create quality jobs: GST, Note Ban to Formalise Indian Economy: GST Council may clarify on tax rate for solar modules at 3 June meeting. RBI guidelines on P2P lending platform likely by June-July. Honda Cars Joins Hands with IBM Watson. India, Russia Plan FTA in Eurasian Region. CBEC Chief rules out GST rates review. RBI discusses debt recast plan with stakeholders.

Sebi norms for NCDs in mergers. Govt may reduce PF contribution to increase take home salary. Long-term anti-dumping duty to benefit hedging forex currency firms. Now, Definition of Startup Enlarged.

NRIs under I-T lens after taxmen seize Rs cr in old notes. Anti-profiteering body likely under CBEC. Make in India gets sourcing push from govt.

GST Council may reconsider steep levy on hybrid cars. I-T dept unearths benami deals. GST Data Trail to Help SMEs in Securing Credit. GST will Help Lower Food Inflation: SFIO developing early warning system to detect frauds.

Bill to address bankruptcy in financial sector soon. Sebi Issues Framework for Mutual Funds, Portfolio Managers at IFSC. Digital India to be Run Like Corporate Entity.

Govt notifies regulations for voluntary liquidation. CBDT Signs 2 Unilateral APAs with Taxpayers. Sebi investigated cases in Apr-Dec FY RBI to Arm Oversight Committee in Big Battle Against Bad Loans. GST The Road Ahead - GST Rollout to Bring Down Prices: India Inc ready for July 1 GST roll out: Financial services transactions to become marginally dearer.

Government initiates work on shifting financial year to January-December. WTO Calls Review Meet, India Opposes E-comm in Agenda. After fixing rates, GST Council to now focus on price behaviour of companies. GST Council fits services under 4 slabs. Supreme Court defers hearing on plea challenging mandatory use of Aadhaar.

Govt plans law to confiscate assets of fugitive economic offenders. RBI revises definition of what constitutes a bank branch. Govt Modifying Manufacturing Policy. I-T publishes names of Delhi defaulters owing over Rs 10 cr in taxes.

Respite likely for biz on e-way under GST. SAT will get new bench in Delhi. GST Council Meet Starts from Today. Maternity benefit scheme online tutor jobs from home in hyderabad India.

I-T base expands by 9. EPFO reduces claim settlement period to 10 days. Govt gives last chance to NGOs to file annual returns. GST Exemption List Likely to be Kept at Around Items. Op Clean Money Portal Launched to Track Evaders. FSSAI to Take Strict Action Against Adulteration. Sebi unearths Rs 34,crore tax evasion. Firms must disclose securities deals above Rs 10 lakh by May Have a tax rate that disincentivises cigarette smuggling: New tax accounting standards may reduce leeway for infrastructure companies.

No tax scrutiny of big transaction if it matches income. GST panel works out rates for 6, items. I-T scanner on end-beneficiary details of P-notes. Startup Inc's Sop Story to be Part of Book of Jobs. Banks Set to See More Gaia online easy money on New Norms.

I-T Dept Starts Facility to Correct PAN, Aadhaar Errors. Govt issues critical alert over ransomware threat.

Registration for GST enrolment to reopen on June 1. P2P Lending Startups Forex trading trend strategy Funding Woes. Insolvency Resolution Time for Smaller Cos may be Shortened. I-T Dept Launches New Facility to Link Aadhaar with PAN. NCLAT ruling weakens insolvency and bankruptcy code, say experts. I-T to probe cases under benami act. Onus on States to Push Labour Reforms. RBI REERs flag an overvalued rupee.

India to say no to WTO trade facilitation deal. Gujarat Assembly passes state GST Bill.

Share/Stock Market News - Latest NSE, BSE, Business News, Stock/Share Tips, Sensex Nifty, Commodity, Global Market News & Analysis - icoqerum.web.fc2.com

No plan to tax agri income; rich farmer very rare: GSTN enrolment halts; to restart later. Need to Hand Incentives to Foreign Arms Cos: FSSAI panel proposes strict steps to check consumption of junk food.

ED, I-T dept set to get more powers. Govt likely to amend NIA in monsoon session. EPFO to make all payments to members electronically. Digital Kiosks to Help Govt with GST Rollout. Promoters Must Disclose Shares Received in Gift: Adhia hopeful of smooth GST transition.

I-T Plans Portal for Non-intrusive Probe. Start-up policy to get makeover. ICAI Asks Auditors for Disclosure on Junked Notes. RBI advises banks to have fair process for selecting auditors.

Land Bill on the Agenda as Joint House Panel options straddle trade Meet on May RBI issues norms to hasten stressed asset resolutions via joint lender forums. CBDT proposes fair market value for taxing unquoted shares. Govt notifies changes to Banking Act.

Stressed assets may be put on the block. Haryana Goods and Services Tax Bill passed. SC reserves verdict on Aadhaar-PAN linkage. New policy to help, but core sector must use more steel. Ordinance to tackle bad loans cleared. Madhya Pradesh Assembly buying stock margin leverage GST Bill Andhra may opt for new fiscal year.

Widen the tax net to include agriculture. Modi trains guns on benami properties. Centre softens stance on i-banks for PSU mandate. Online Registration Mechanism for Securities Market Intermediaries.

Taxpayers Surge by a Crore. States Asked Not to Accept Cash Payments for Electricity Bills. GST rates likely to be fixed by weekend.

Aadhaar for PAN to check black money: Budget session of Parliament likely to begin on January 3. SMEs approach FM for extension of GST launch.

Compliance Cost Won't Rise Under GST: Moving in sync with the times. Aadhaar to be made compulsory for filings. Tax liability after amalgamation. Obligation for the Month of May SMS for Week ended You may need to fill 37 forms to be GST-compliant. Filing of online return for 4th quarter of extension of period thereof upto States Free to Tax Agriculture Income: Banks can't refuse scribbled notes, says RBI circular.

Ind directors are not independent: Big Rate Changes Unlikely under GST: BIS proposes script meaning in stock market registration for selling hallmarked jewellery.

Compliance rating for industry under GST. Service Tax Return Filing Date Extended to April Panel lens on diluted realty regulation law. NITI Aayog bats for continued labour reforms. Now, withdrawal of PF without medical proof. Wait time for patent examination to be cut to 18 months by March Telecom companies begin state wise GST registration. Modi to review GST, black money policy. Sebi Clears Options Trading in Commodities.

No plan to tax farm income, says Jaitley. Tax receipts jump to record levels. Getting the trade to align with GST is a challenge. SC talks tough on Mandatory Aadhaar for PAN cards. Relief for Indian MNCs Likely as Govt Considers to Dilute POEM. Tax on Agriculture Income Part of Niti's Action Plan. New RTI rules could put whistleblowers at risk, say activists.

With GST, in placethere would be uniformity in imposed taxes. Bihar becomes second state after Telangana to pass GST bill. Sebi pending cases surge after new norms. Norms Soon on Fund to Back Infra Bonds. Govt extends SIPP scheme for 3 years till March PM asks states to speed. GST boost for brick-and-mortar retail expansion. CBEC gears up for GST roll-out. Extension of time for filing declaration under the Taxation and Money makers live smc Regime for Pradhan Mantri Garib Kalyan Yojana, Cesses, VAT behind high bills, not service charge.

Draft GST rules seek detailed paper work. Govt open to September roll-out of GST Sticking Points. Centre faces Supreme Court poser on mandatory Aadhaar for PAN cards. Friendly Advance Ruling Mechanism to Smoothen Ride Under GST Regime.

Panel to Review Misconduct Rules for Accounting Pros. Major FPIs shift base after new tax pacts. Records of goods lost, stolen, gifted amust under GST draft rules. Maharashtra housing regulator from May 1. GST reform microsoft stock market symbol lookup /trading/symbol-lookup.php act of courage: Clarification regarding online generation of Challans for Offline payment cases.

Govt releases further draft rules on GST. Small businesses could under report income under GST initially. Deposits under PMGKY can be made till Apr GST ambiguity on gold jewellery. Sebi may grant single licence to brokers. Govt to Widen Entry for Foreign Funds While Shuttering FIPB. Operation Clean Money Top Priority This Quarter: Govt Notifies Remaining RERA Sections.

Most states to pass GST Bill by May end. Guidelines on compliance with Accounting Standard AS 11 [The Effects of Changes in Foreign Exchange Rates] by banks - Clarification. India Inc seeks wynn stock premarket on capital gains tax proposal. FPIs Want Block Deal Rules Relaxed. Simpler Credit Rules on Way for Poor Households.

RBI wants banks to make more provisions even for good loans. Google tax closes in on internet firms. Five ways how doing business will be different under GST. Update details to link PAN and Aadhaar. Paris Replacing Mauritius as Tax Haven, Citi Alerts Finance Ministry. GSTN ready for last-minute rush from taxpayers. Decoding the indirect tax regime.

Regulator Set to Block P-Note Route for NRIs. One Group, One Tax Likely in GST. Cos Report Better CSR Compliance in FY I-T lens on 60, depositors. CBEC proposes eway bill for goods worth Rs 50k.

NCERT Solutions class B Study 10 Financial Market | icoqerum.web.fc2.com

Cleanliness Campaign Against Black Money'. Companies Compromises Arrangements and Amalgamations Amendment Rules Aadhaar may be Made Compulsory Under Cos Act. SC Dismisses Plea on Income Disclosure Scheme. RBI tightens screws on banks to ease bad debt. Stricter monitoring of IPO proceeds by small firms. GST to bring more peopleits under tax net: Accounts used to get remittances to be blocked if full details not given.

ESIC launches AAA mobile app. BSE asks firms to file financial results via XBRL mode. Rent receipts are not enough for HRA claim. EPFO extends deadline for submitting Aadhaar to April Third Arbitrator in Global Dispute must be from Neutral Nation. FIs told to furnish self-certificates of US account holders by April New firms get PAN,TAN in a day.

Govt to help banks speed up decisions. GSTN to Encrypt Tax Data, Add Two Layers of Security. New Laws Bring P-Notes Back into Limelight. Safe-harbour margins to be cut.

No proposal to review FDI in multi-brand retail. Companies to file fewer reports under labour law. GSTN May Ease Eligibility for Third-Party Service Providers.

Redoing laws for the GST regime. All cash payments of over Rs 2 lakh to be shown in ITR. Link Aadhaar with PAN via ID proof scan, password.

FPI Custodians, Tax Consultants in Deadlock Over GAAR Liabilities. Court can replace arbitrator. RBI to issue final guidelines on MDR charges. Banks may not rush to invest in REITs, InvITs. RBI promises more effective steps to tackle NPA pain. NEFT transfer to get quicker as RBI cuts clearance time. Parliament passes Bills to pave way for GST.

LS passes Bill to make excise Acts compliant with GST. GST may Make Gold Costlier. No Rs 2-L Cap on Cash Withdrawals from Banks, Post Offices. Banks want RBI to relax norms for loans to highly indebted companies. LS passes Employees Compensation Bill.

Aadhaar must for expats who stay for more than 6 months. Go online to reduce mis-selling. Rent Receipts Under I-T Lens. Expats Stressed As Aadhaar Becomes Mandatory for ITRs.

Revenue wing allows time till Apr for GST registration. New tax plans worry market participants. Sebi circulars cannot be challenged in SAT, rules Supreme Court. How the GST Network works.

Litigation and tax disputes concerns before new regime kicks in. Five things to know about GST. Govt asks firms to disclose details about junked notes. Only credible complaint to trigger GST anti profiteering clause. Reserve Bank Set to Get More Teeth to Chew on Stressed Assets. No Capital Gains Tax on Share Transfer Via IPOs, Bonus Issues.

Losing Countervailing Duty Exemption Shield Likely to Hurt Handset Makers. New GST rules may inflate prices of old vehicles, durables, smartphones. CVD Exemption Unlikely, Says Adhia. RTI Cases Likely to be Closed After Applicants' Death.

RBI likely to keep rates unchanged. Premium collected not tax-deductible. GST will be implemented from July 1: Investment by Foreign Portfolio Investors in Government Securities. Pay more under GST for exchange offers. GST Council to decide on rates in May. New 1 page ITR form notified, e filing to start today. Small savings rates cut by 0.

Form 1 can be filed by Apr 10, if deposit made by deadline. GST makes inroads into agriculture sector. Obligation for the Month of April.

Clarification regarding legislative changes relating to customs Act proposed in financial bill Create structure to enable lenders to tackle bad loan. Anti-profiteering Clause in GST is Transitory, will Act as Deterrent. We will take September roll-out demand to GST Council: Council to finalise rules for new tax regime today.

GST to hit shadow economy: Select ITdept offices to be open till Mar Lok Sabha approves Finance Bill, rejects changes made in Rajya Sabha. Lok Sabha clears GST Bills: Focus now on rules, specific rates. Govt services, office freebies may attract GST. All payment systems to remain closed on Apr 1. Another Step towards GST.

Post Leak, Govt Gets into the Aadhaar Act. No Relief for Assessees Not Paying IDS Money. Sebi gets back discretionary powers on penalties. Bankruptcy Act a Perfect Recovery Tool for Banks. Govt wants to pass GST Bills through consensus: Land leasing, renting to attract GST from July 1. IDS II gets cold response. Gradation system likely in debt recasts. Petroleum sector to be part of GST soon: Single-page form for income up to Rs 50 lakh. CBDT to waive interest if tax demand paid in retro cases.

Aadhaar gets more teeth. Racing Towards GST, I-T to Hold Industry's Hand. Bankruptcy Norms for Individuals in the Works. When the Finance Bill goes beyond Budget making. Less taxes on wheels: High-end car buyers to benefit from GST.

Regulatory measures of SEBI for Secondary Market reforms in India

Market Banks on Bad Loan Solution. Coffee-Toffee, the GST Debate Continues. FinMin meets bankers to sort out liquidity issue. Tax deductions on health insurance premiums. All Agency Banks to remain open for public on all days from March 25, to April 1, ICDS provisions to prevail over judicial precedents: Sebi turns heat on concentrated bets of bank index funds. P-notes may take hit on new tax treaties. Jaitley underlines urgency to pass GST bills in this Parliament session.

India notifies amended tax treaty with Singapore. No tax to be charged on cash purchase of above Rs 2 lakh. Aadhaar-based KYC Likely Across Financial Sector. Sebi eases rules to boost municipal bond market. Gifts to Trusts for Benefit of Kin Exempted from Tax. Cap on corporate funds for political parties goes. EPFO cuts admin charges to 0.

World Bank, IMF to assess Sebi's regulatory framework. Companies Indian Accounting Standard Amendment Rules, Cash transaction limit lowered to Rs. Start ups, NBFCs seek exemption from debt norms. GST casts shadow on state Budgets. Aadhaar to be must for IT returns. Sebi wants MFs to adopt tougher benchmarks. GST Relief for Exporters, Some Refunds to Continue.

Cabinet approves draft GST Bills. Regulator mulls single window check-in for foreign investors. Protect tobacco farmers' intrest in GST law: GST Centralized assessment for service-oriented industries likely. Move Afoot to Ease Norms for VC Funding in Startups. Law panel against tax relief for single parents. Tax dispute resolution window has few takers. Capital gains tax worry for BSE Shareholders. Getting SMEs ready for GST. Cabinet likely to consider GST supplementary legislation today.

Raising tax could at times be a 'retrograde' method: Not many changes in GST rates say officials. Cigarette stocks rally as 'sin tax' concerns go up in smoke. Criminal action can be initiated against wilful defaulters. Windfall for Govt with Enemy Property Bill.

FDI cap tweak in print media in the works. Avoid withdrawing provident fund money to buy a house. Reporting and Accounting of Central Government Transactions of March New building code to hold developers liable for safety. SEBI issues guidelines for MF celebrity endorsements. Council meeting to pave way for GST Bills in Parliament, Assemblies.

Notices Sent to 1, Firms for CSR Non-compliance. Govt to present fresh consumer protection Bill. IT prosecution action triples in FY Parliament passes Enemy Property Bill.

EPFO exempts S'pore citizens from mandatory PF contributions. Today ,15th March is the last date to pay your 4th and final instalment. Loan Lifeline of up to Rs 5 cr Likely for Startups. Panel Reviews Impact of Steps on Easing Cross-border Trade.

Sarfaesi rule clarified to speed up action. Tax check in GST regime. Fast track cases against shell firms: Labour reforms may get going, finally. Have any Query Click Here Our Service Audit Services Indepthh studyy of existing systems, procedures and controls for proper understanding. Read More Income Tax Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Read More Service Tax Registration under Service tax, Consultancy for maintenance of proper records, Consultancy for proper accounting for Read More Accounting Services Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices Read More Corporate Services Incorporation of company, Consultancy on Company Law matters, Planning for Mergers, Acquisitions, De-mergers Read More Payroll Preparation of Monthly Salary Sheet, Deductions as per applicable laws like Income Tax, Provident Fund, Professional