Hud home earnest money check

Top Real Estate Agent Brentwood CA, Brentwood CA Homes for Sale, Brentwood Ca Real Estate, Realtor in Brentwood CA. The selling agent will be required to complete an addendum providing the name and contact information of the selected escrow company. This addendum must be submitted with the contract package at the time of bid acceptance. There are three listing periods: Certain properties are featured in the Lottery Period for the first 7 days on www. These properties are available for purchase by Good Neighbor Next Door participants, HUD-registered non-profit organizations, and government entities.

When the Lottery Period ends, these properties enter the Exclusive Listing Period. Properties in the Exclusive Listing Period are available for purchase by Owner Occupants, non-profit organizations, and government entities.

The Owner Occupants Guide to Purchasing HUD Homes - Invest Four More

If the property is being sold as Insured IN or Insured with Escrow IE , the Exclusive Listing Period is 30 days. Bids received during the first 10 days are considered to be received simultaneously, and the initial bid review is on the 11th day of the Exclusive Listing Period.

If there is no winning bid, bids continue to be reviewed on a daily basis Monday through Saturday until the day period ends. If the property is Uninsured UI or Uninsured k eligible UK , the Exclusive Listing Period is five 5 days. Bids received during these five 5 days are considered as though they are received simultaneously, and are not opened until the 6th day of the Exclusive Listing Period. In return you must commit to live in the property for 36 months as your sole residence.

Eligible Single Family homes located in revitalization areas are listed exclusively for sales through the Good Neighbor Next Door Sales program. Properties are available for purchase through the program for seven days.

Check the listings for your state. Follow the instructions to submit your interest in purchasing a specific home. If more than one person submits on a single home a selection will be made by random lottery. HUD requires that you sign a second mortgage and note for the discount amount. The number of properties available is limited and the list of available properties changes weekly. The housing market is doing remarkably well this year compared to last year.

We are seeing an increase in buyers as well as prices. Prices are … [Read More The media is known for making fallacies so they can make a quick buck.

I get asked all the time from people who are wanting to sell or who are just simply curious about what their home is worth. Many people are curious … [Read More I was lucky enough to interview Josh Aldrich who is the CEO of Del Sol Energy. He told me all about the best ways to purchase solar panels, what to … [Read More Have you ever wondered about the benefits of a Trust and if they really benefit your family?

HUD earnest money question? | Yahoo Answers

Well I have and interviewed Michaell Rinne a Trust and … [Read More Have you ever heard of a reverse mortgage? Or Wondered How a Reverse Mortgage could be beneficial to you?

I interviewed Tom Pinocci a reverse mortgage … [Read More Home Featured Listings HUD Homes Prevent Foreclosure Real Market Reports. My Blog Contact Me. Brentwood Homes Antioch Homes Oakley Homes Discovery Bay Homes. Concord Homes Pleasant Hill Homes San Ramon Homes Dublin Homes. Alameda County Pittsburg Homes Danville. HOMES BY KRISTA - Brentwood Office: Skip links Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer.

Homes By Krista Top Real Estate Agent Brentwood CA, Brentwood CA Homes for Sale, Brentwood Ca Real Estate, Realtor in Brentwood CA. Home Search Homes Property Tours Market Updates Buyers Sellers Blog Prevent Foreclosure About Krista Testimonials. Coming Soon Featured Listings Brentwood Discovery Bay Oakley Antioch.

HUD FAQs Buy HUD Homes Selling HUD Homes Find HUD Homes HUD Financing FAQs Forms. A HUD home is a 1-to-4 unit residential property acquired by the Department of Housing and Urban Development HUD as a result of a foreclosure action on an Federal Housing Administration FHA -insured mortgage.

HUD becomes the property owner and offers it for sale to recover the loss on the foreclosure claim. If you have the cash or can qualify for a loan subject to certain restrictions you may buy a HUD Home. HUD Homes are initially offered to owner-occupant purchasers people who are buying the home as their primary residence.

What a mess: My HUD home inspection and purchase problems. Help?! - Trulia Voices

Following the priority period for owner occupants, unsold properties are available to all buyers, including investors. The Principal Broker designated broker for your company or office must register by completing SAMS Single-Family Acquired Asset Management System forms and A, and attachments. All forms must be signed by the designated broker. Registration must be renewed annually using the same forms to maintain current status. You can register and obtain your NAID number by visiting www.

It takes approximately 6 to 8 weeks for processing. A NAID number is a Name Address Identification Number issued by HUD.

This number allows the agents and brokers to submit bids on behalf of prospective buyers of HUD homes. The Listing Broker provides assistance to realtors with access to the property and with sales information. Yes, Please contact a Real Estate Agent of your choice that is HUD registered. If you are not working with a Real Estate Agent, please contact the Listing Agent for more information or our sales team at You may utilize our FREE HUD Homes Photo list located on the Home Page of this site.

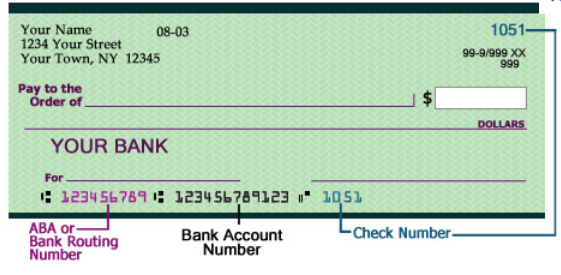

You may also contact a Real Estate Agent of your choice that is HUD registered. You can use FHA or conventional financing to purchase a HUD home. You may also purchase a property with cash. During the exclusive listing period, bids may be submitted by Owner Occupants. At the conclusion of this exclusive listing priority period, all general public bids will be accepted. Please note, This is a change from previous notices that will be effective with this pilot program. The purchase of the property may be declined at any time, but may be subject to earnest money forfeiture.

If the offer is rejected, the earnest money is usually returned, since no binding contract has been entered into.

If the buyer retracts the offer or does not fulfill its obligations under the contract, the earnest money is forfeited. All purchasers are strongly encouraged to perform a walk through inspection at or near the date of your contract acceptance and, again, immediately PRIOR to closing. The purchaser or agent should complete the Property Damage Report and fax it to the appropriate fax number listed on the form.

Reporting the damage does not guarantee the correction of the problem that has been discovered. The lack of written documentation describing property condition at contract acceptance, however, will preclude consideration for repairs or price adjustments in the event of subsequent damage.

Each case will be looked at independently and a determination will be made as to whether the damage will be repaired or not repaired or, under some circumstances, credits given at closing.

The buyer assumes full responsibility for the property and its condition on the date of closing. HUD assumes no responsibility and will make no settlement for damages reported to HUD after the close of escrow. HUD properties are sold as-is with no warranty. No repairs should be performed on a property until after the new owner has taken possession of the property.

However, a home buyer may wish to utilize an FHA K streamline loan to finance repairs on the property. The answer depends on the type of financing being used. Please contact a Real Estate Agent of your choice that is HUD registered. If you are not working with a Real Estate Agent, please contact the Listing Agent for more information.

The cancellation form can be found in the forms section of this website.

There are three main types of FHA Financing. More information may be obtained from any mortgage company familiar with FHA Guidelines for the various programs. The FHA appraiser lists the estimated cost of repairs needed to bring the property up to minimum FHA standards. The DE Underwriter will determine the final b mortgage amount. The DE Underwriter will take into account the repair escrow amount to determine the FHA loan amount.

The DE underwriter will determine this amount. The line associated with the length of the loan should also be filled in TBD. Please remember that the repair escrow amount needs to be filled in only if the buyer is using b repair escrow financing. HUD will allow to be deducted from its proceeds, purchaser financing and closing costs that are considered to be reasonable and customary in the jurisdiction where the property is located.

Please reference HUD Notice H for additional information. A Pre-Qualification Letter must be obtained prior to bidding on a property. This is to avoid having to tie up the property with a transaction that is unlikely to close. The Pre-Qualification letter must be directly from the lender NOT the mortgage broker giving a current date and an amount of the loan that is acceptable.

It should also include the name the buyer s whose credit report was reviewed and approved by the lender. Properties may close in less than the timeframe specified.

If closing does not occur within the timeframe then extension fees will apply. The Broker must submit a written request for an extension regardless of the reason for the delay in closing.

The Extension Request Form can be found in the forms section of this website and must be accompanied by the extension fee. How the Program Works Eligible Single Family homes located in revitalization areas are listed exclusively for sales through the Good Neighbor Next Door Sales program.

How to Participate in Good Neighbor Next Door Check the listings for your state. This special sales program under which approved non-profit organizations and government agencies may purchase properties at discounted prices for use in local housing or homeless programs. More information on this program can be found at http: Even if they are the one who is making the purchase. It does not matter whether the broker is buying the home as an owner occupant or an investor.

If a buyer has a TIN or EIN, they are allowed to bid. However, if they are an Owner Occupant, they must prove that they will be living in the States for at least a period of 12 months to cover the Owner Occupancy period. The two day window between bid acceptance and the delivery of the contract package is the only opportunity the buyer has to cancel bid without placing earnest money in jeopardy.

FHA guidelines will limit the underwriter to insuring the loan for the lower of two values; the offer price or the appraised value displayed as the As-Is Value. If your offer price is higher than the appraised value, the FHA underwriter will require that your buyer s cover the overbid amount with a cash deposit. The buyer s will not be allowed to build the overbid amount into an FHA loan.

This mortgagee letter instructs the FHA UW NOT to obtain a new appraisal; nor can the FHA UW request that new comps be pulled and the appraisal updated. If your offer price is higher than the appraised value and tentative acceptance is extended to you, the options available to you are: Proceed with contract execution. The selling broker will be required to verify that the cash reserves are available to cover the overbid amount before we execute the contract.

Use cash or conventional financing. All of the guidelines outlined above apply to FHA financing only. A conventional lender will have their own set of guidelines not governed by HUD. Cancel prior to contract execution. If there is an acceptable backup, we will award tentative acceptance to the backup offer. If there are no acceptable backup offers, the property will be relisted. Property Search Min Price:. From The Blog… Local Market Update and Loan Qualifications The housing market is doing remarkably well this year compared to last year.

Footer Home Featured Listings HUD Homes Prevent Foreclosure Real Market Reports.